In November 2021, we foretold the coming MOONFALL of Q1 2022.

The thesis was based on weak post covid recovery of the West and the manipulation of reality to save face in the moon worshipping corners of the world. At the time, the global economy was hanging on the impacts of COVID.

In December 2022, we urged you to SELL! In case you missed the Nov call.

Now a year on, Asia has no recovery to show. Many economies are in worse shape with the heavy weighting of real estate on balance sheets, as we enter the global housing collapse.

Once again we predict a crash between now and the lunar new year (22 Jan 2023).

If Moonfall 2.0 does happen, it presents an opportunistic pullback in January. If craters are averted, we are still bullish on the S&P500, with an eventual target of 5000 over the coming 12 months or so. Based on inverting the reality of declines with interventions and artificial growth.

The sun-worshipping economies’ post-stimulus fake recoveries have run their course. Diluted currencies, rising inflation, and rising interest rates are all deflationary. Survival is now the priority in countries requiring heating, not feeding economic growth from discretionary spending fueled by credit.

If Western demand is reduced and the Chinese housing market is cooling off, domestic demand might not be enough for a strong reopening in China. There is only a short window to review bonus levels that will have been decided during the closed economy.

Even the opening up of travel again for Chinese is not going to help many of the countries around the world with tourism income who are currently imposing travel bans.

Once international supply chain backlogs are cleared we should be able to see the true dynamics of supply and demand. Barring some knee-jerk reactions to save us from cross currents, which simultaneously obfuscate the unveiling of reality.

2023 CROSS CURRENTS

-Economic Data of the Post-Covid World, earnings down

-Strikes in supply and demand economies

-Economic Intervention by Central Banks to complement Health Policy Intervention by Global Health Organizations

-War Overhang Coming Soon! World War III

-Terrorism with high fatality leading to Civil Wars

-Civil Wars and State V State wars leading to multistate wars

-More COVID variants emerging and continued supply chain disruption

-Inflation

-Interest rate hikes and future back peddling

-Cryptocurrency crash

-Oil shock

We can gauge the reality of the global economy from the building of the tower of babel, the prison planet grid. Post-pandemic, we saw a premium on semiconductors as supply chain opened up again. Risk overhang from the threat of war with China over Taiwan, had kept demand up in the tech race.

The price drop of semiconductors in recent months signals trouble in the West and East. This is while countries are scrambling to build their own chip plants as a matter of national security.

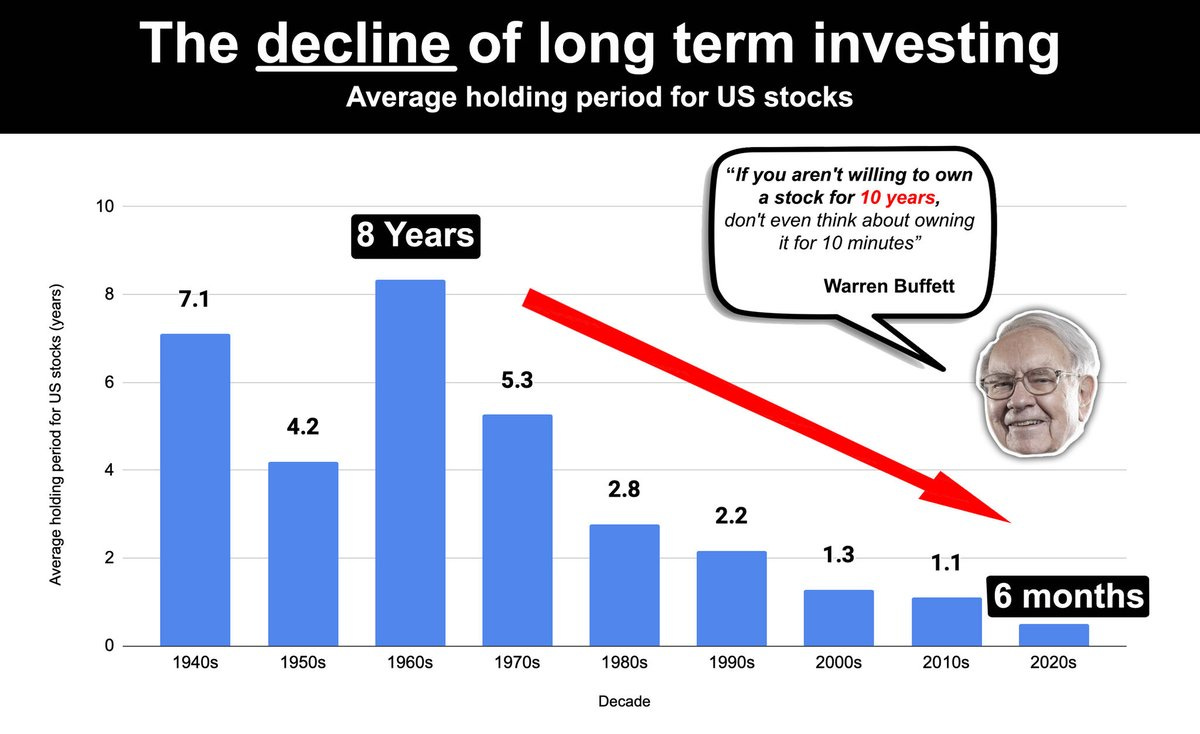

Inflationary pressures on stocks that caused rises in share prices is one of the reasons the overall markets need to drop.

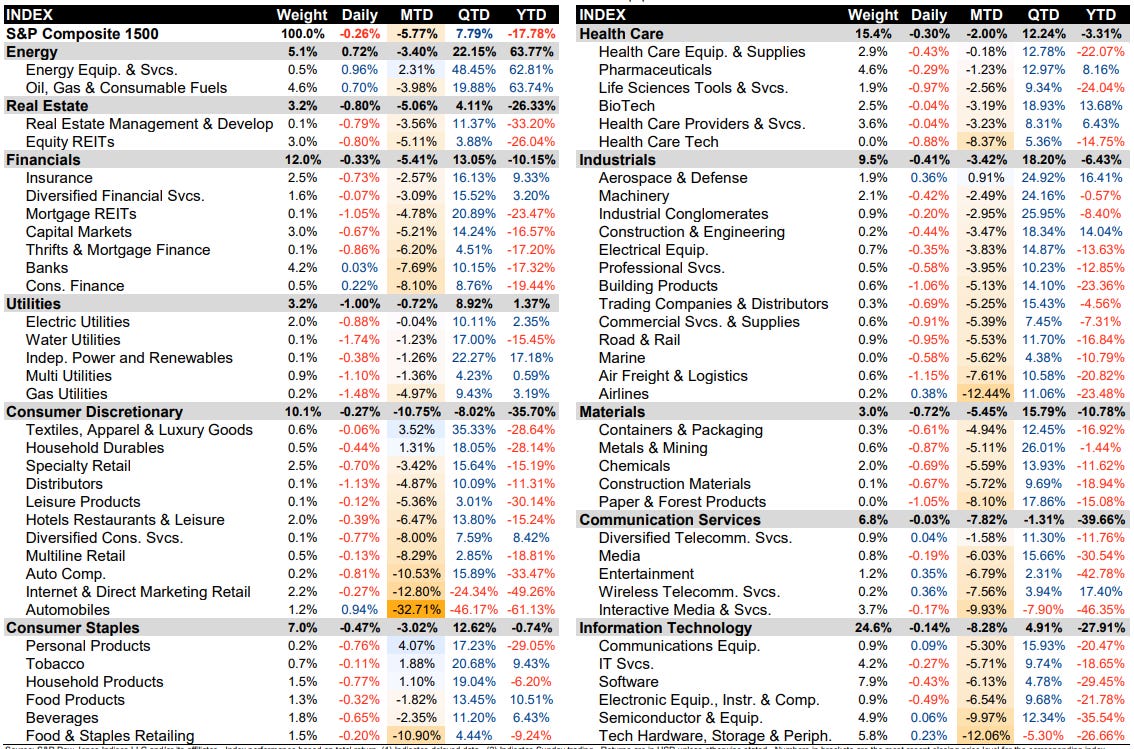

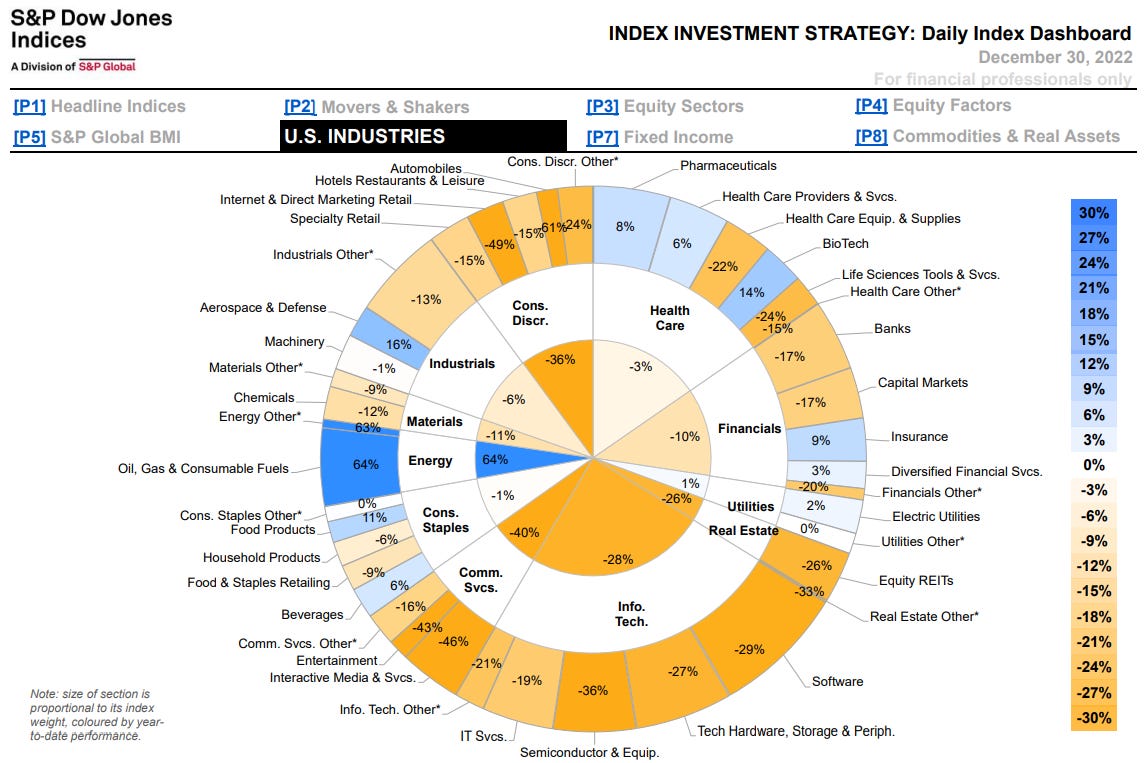

The key to riding out the storm is to compensate holdings for vulnerable and buoyant sectors in the portfolio ratio.

We are looking at -5% drops in sectors at risk. The full macro bearish sectors will come under pressure. Areas where rates and liquidity are major factors. eg real estate and consumer discretionary spending.

Other non risk sectors, benefitting from inflationary pressures, we have allocated -0% factor. Such as energy and health care.

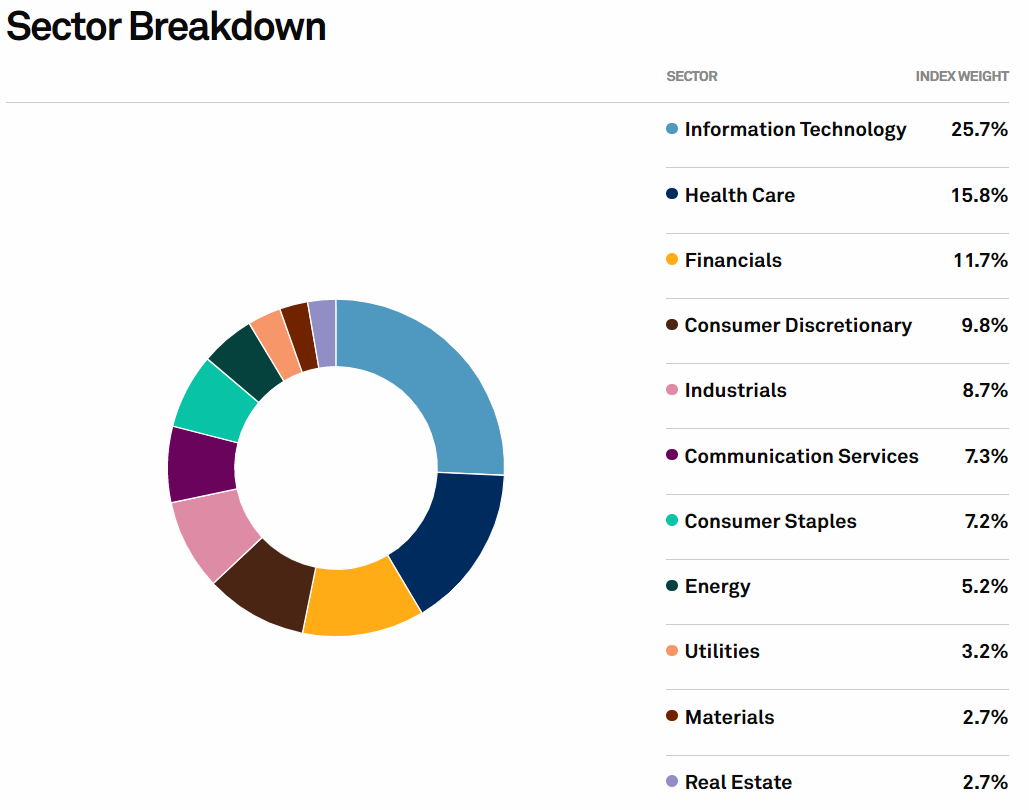

S&P500 2023

Information Technology 25.7 (-5%) = 24.41

Health Care 15.8 (0%) = 15.8

Financials 11.7 (-5%) = 11.12

Consumer Discretionary 9.8 (-5%) = 9.31

Industrials 8.7 (-5%) = 8.27

Communication Services 7.3 (-5%) = 6.94

Consumer Staples 7.2 (-5%) = 6.84

Energy 5.2 (0%) = 5.2

Utilities 3.2 (-5%) = 3.04

Materials 2.7 (0%) = 2.7

Real Estate 2.7 (-5%) = 2.57

TOTAL 100%

-3.44%

= 96.56%

S&P500 rounded 3860

-3.44%

= 3727

CALCULATING RISK

If we take the example of the global financial crisis, led by real estate, a small sector of the market at around 3%. The systemic risk created by the real estate index trickled into materials, industrials, financials and ultimately central banking. Besides the collapse Fanny Mae & Freddie Mac.

We will see sector specific issues, which have limitations on their potential to spill over into other sectors. For example the link between communications and discretionary spending at the box office could be affected by credit and snow storms.

We can assess the risks differently from those sectors whose elements have the ability to cause systemic losses. IT was a sheer multiplier in beta, in the recent post COVID run up, leading the decline in FANG stocks over the last six months.

We continue to believe in content as a long term trend. We have reached the bottom in content. Demand will continue in a downsizing economy and if covid or other reasons cause a closed economy. The Definitive Guide to Investing in Cultural Assets

2023 CRATERS

The market has already been weak for a few weeks based on the breakdown of the economy and war led geopolitical tensions.

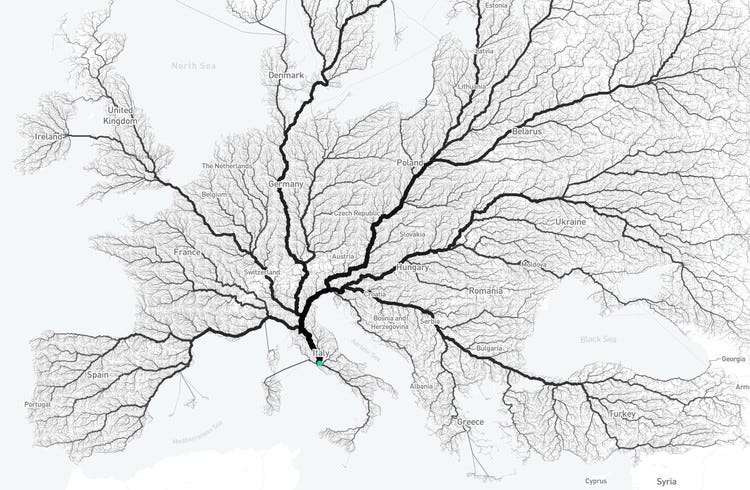

Ultimately, we are looking at an investment manifesto based on centralization to the omega point.

We will see continued relative strength in USD in direct inverse proportion to the decline in the US’s global influence and real economic activity. As the decline accelerates, so will the rise in USD.

As the rest of the world suffers through currency devaluation in relation to the dollar, it will put the US in a unique position to pivot in a domestic and coalition based economy. As the US has both the finance and demographics to support future growth. Unlike other countries in the G7, leaving no serious contenders to challenge the empire.

Global arbitrage will be based on trading between markets, sectors and currencies to find the fleeting pockets of light. The exponential age has brought us a market that reacts to signals in real time and back doors from do-gooders like central banks and the plunge protection team, who will work to address systemic risk with all the tools at their disposal.

Many leading banks and global financial institutions are predicting a recession for 2023, but there are many variations about exactly when and how bad. With everyone poised, there will be inevitable reactions to compensate. As the effects of crashes may not show up in the obvious places because of such actions, it will be the time to keep a 360 degree eye out for distortions.

Earnings reports from 2022 Q3 for S&P500 companies showed negligible growth, after Moonfall 1, we have seen a macroeconomic slow down. The new normal is unstable for investors who are caught between rate hikes and market reactions.

Transient windows of opportunity will unintentionally be opened by central powers playing whack-a-mole, then closed again as the distortions are detected. Whole sectors will get wiped out one by one as policies are changed to deal with the emergency of the moment.

INVERSION INVESTING GUIDE TO ↑↓

↑ GOING UP ↑

CONTRARIAN

This is overpriced, don’t buy.

ACTIVIST

Proving us right, buy more.

RELATIVE STRENGHT/VALUE

Buy a related stock / sector with exposure to growth trend.

THE CALLS

LONG

PFE Pfizer Booster Stock

XOM ExxonMobil The Art and Timing of War like a Rothschild

NFLX

WBD

USD THE LAST STAND: DAWN OF THE DOLLAR

maybe DISNEY

speculative long CINE

CMCSA

SHORT

Home Depot

Home Builders The HyperReal-Estate Decline

We are celebrating 10 years since Peter Pham’s book: THE BIG TRADE

was published on 30th November 2012. Get your copy, if you haven’t already.

Making trades to catch the pockets of light requires being tuned in.

We work with investment institutions, family offices, and fund managers. Please get in touch to discuss research and asset management services.

Our free substack publication is for all those with ears to listen, please share with your friends and network.