HIGHLY VALUABLE READ: The following piece you are about to read is based on proven picks that have made astronomical gains within the last few months. Wayne Gretzky hockey card +1,000,000% AMC Entertainment +225%

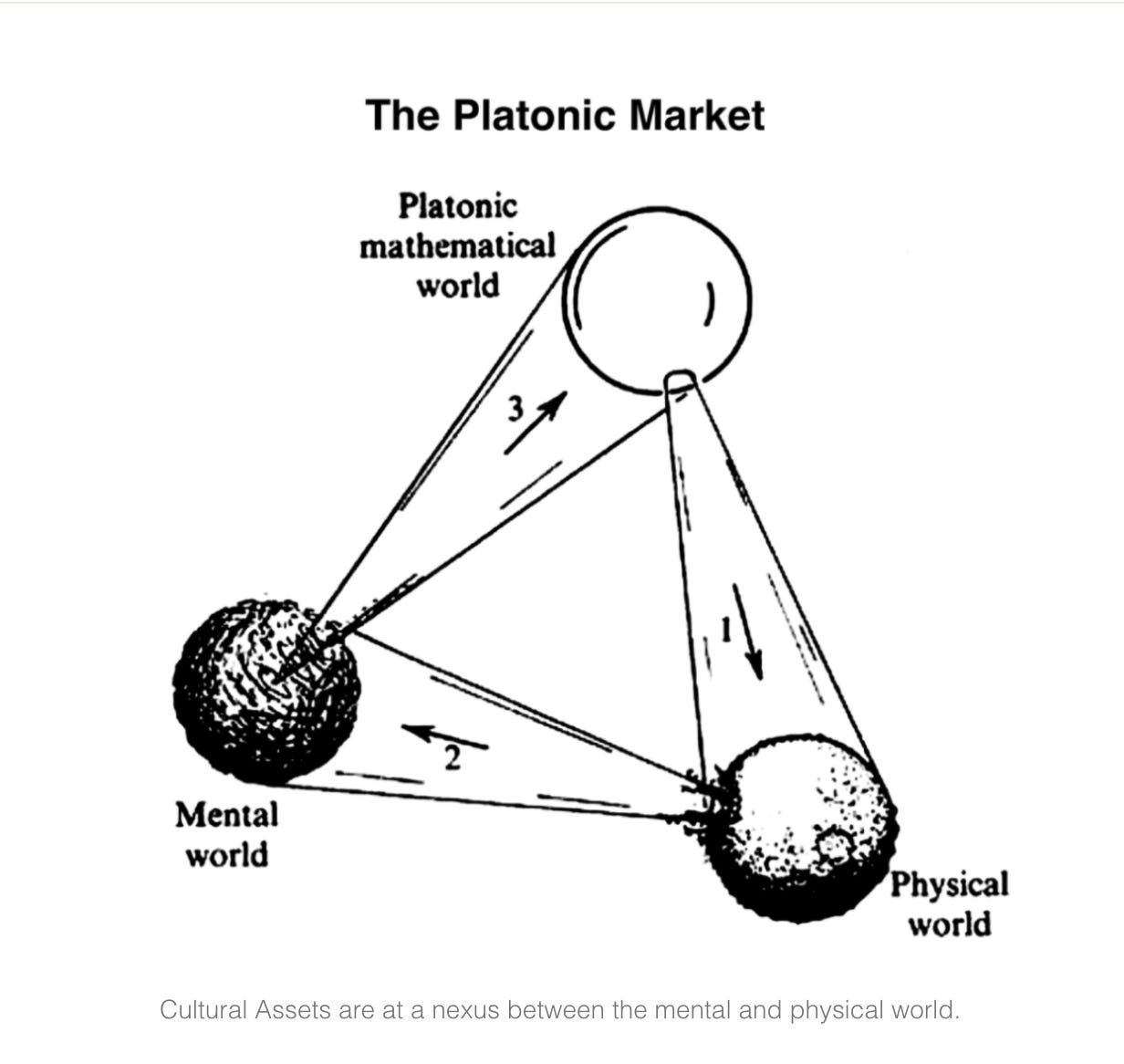

"Most philosophers have known, at least since around 500 B.C., that the world perceived by our senses is not "the real world" but a construct we create — our own private work of art." ~Robert Anton Wilson

Culture is Money

Anyone who gets a craving for it wants to live it. Whether it’s live events or virtual reality, culture is a portal for living out nostalgia.

Culture is about belonging and the way for humans to connect on intellectual and emotional levels. It brings deep comfort and helps us make sense of the world we live in.

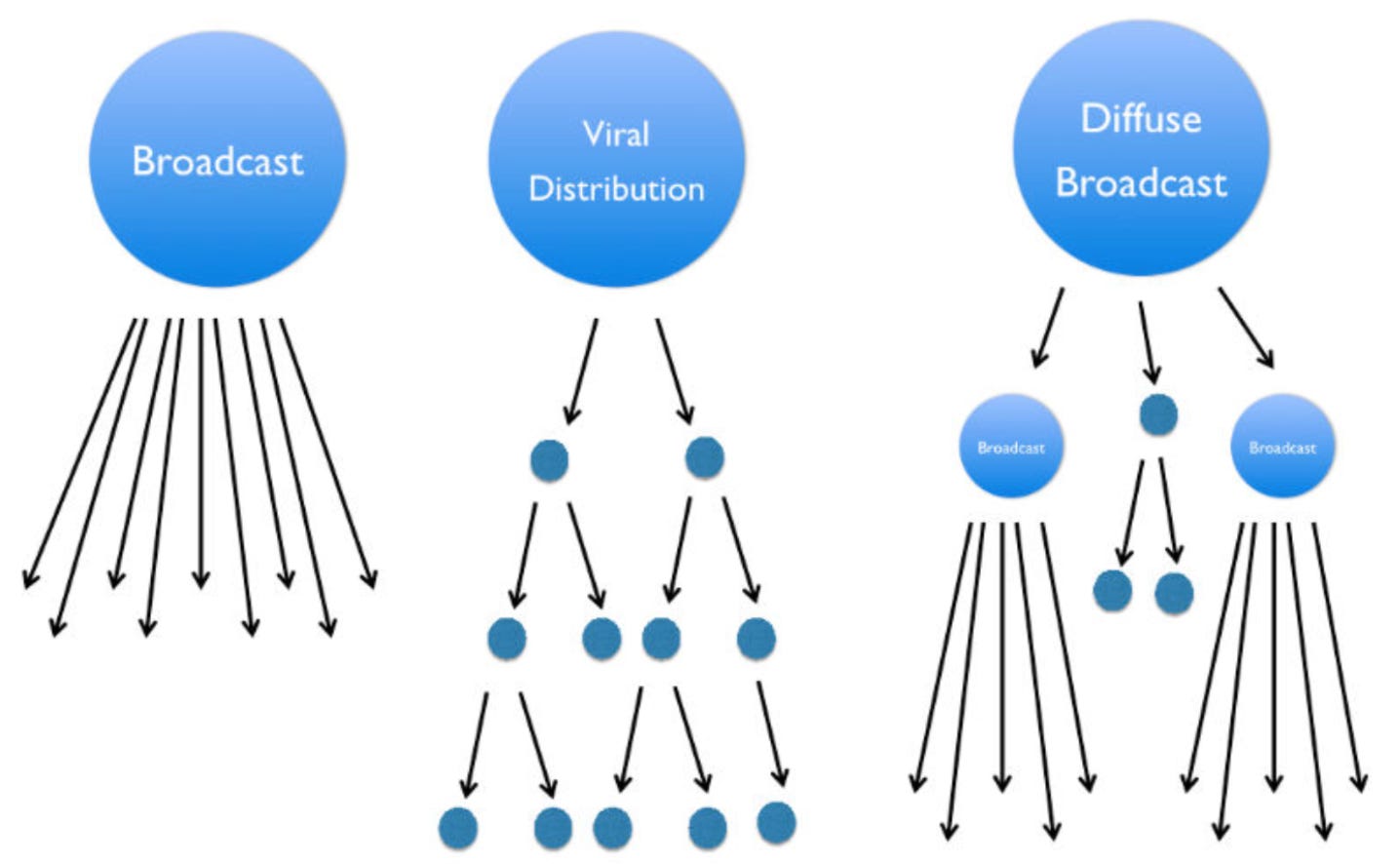

A cultural medium is a gateway into the collective thought, which is like the mental internet, it has the biggest scale of all. The value of the culture is derived from X of what fans think, the mind share bolsters the value. This can’t be done with hard assets like real estate or precious metals, the desire to remain real is an anchor preventing scale and growth.

Scale = value to society. We are not saying fake, we are saying invisible, there is a difference.OK I’m sold, lay it out:

How to Invest in Culture Assets

1. Become obsessed with your culture or subculture of choice:

Who’s Culture? Throughout the world, there are many unique cultures, but for the purposes of investing, we are focusing on anglophone culture of the Western world. Although the principles are also applicable to other main global economies like the EU, Japan or China with high content consumption figures globally. In these areas, we have seen the financialization of culture as an asset class using advanced models. Elements of the invisible economy are manifesting through cultural assets. The things we love in the world, that provide us with escapism, insight, and value. This is how culture gives the assets clout. Until recent times we have associated cultural assets with Western culture. With 95% of published authors being white, it is easy to see how the dominance of Western culture has prevailed. Also, higher class levels have held higher literacy rates. Now we see this turned on its head, with a mass audience, non-white and non-elite cultural symbols selling at values and scale to compete with high art. Historically, old money has placed a premium on fine art and cultural artifacts. Holding wealth in heirlooms and passing on the status as being cultured to future generations . We are now starting to see cultural artifacts from the working and middle classes’ world behaving in similar ways.

2. Study & select the best ways to invest in the chosen culture stream:

We’re just getting started in a culture becoming an investable asset class. The models for monetizing culture are evolving in both the digital and physical world. With their interplay having ever more interesting consequences. Understanding the value as it relates to culture is where the fun is. Also in terms of investing, there are many ways to get exposure. Flipping, buy & hold, cash flowing IP, investing directly or buying shares of listed companies. Whichever mediums and methods you apply, the ROIs are drawing attention and gradually the herd will want a slice. Previously a brave few dedicated their energies to music, sports and cultural careers. With many reaching low levels or moderate success and few making it to the very top. Now there is a new approach to monetizing their interest. What are the chances of making a decent return on trading sports cards vs training to become a pro sportsman. Now that baseball collectors are getting older, they have the disposable income to buy into the portal.

3. Study supply & demand & valuations:

The global collectibles market has a value of $370 billion. (Forbes). Just to put that into perspective, only 30 of the world's countries have national GDPs over $370 billion. Generally, GDPs lower than this are seen as risky or complex, like frontier and emerging markets. Think about the illiquid nature of selling real estate vs the liquidity of selling collector’s items. Plus the high demand and transparency in the relatively small but big market.

4. Set some goals for buying, exit points, and signals:

It’s easy to use your subjective opinion and miss the value shown outside of your own personal tastes or dismiss this as a fad. The few that are willing to use an objective approach will reap the rewards. The auctions for these assets are on eBay, not Sotheby's. Choosing the right items to hold now, could pay off in years to come. Nostalgia can be measured by the significance of culture in future generations. Particularly by 20-40 year old franchises appealing to peak earners now in their 30s-50s. Like millennials who grew up with 80s & 90s shows & movies that are now being adding to Disney+ triggering parents seeking nostalgia and shared cultural significance with their children.

Bonus - Use your circle of influence to add value to cultural assets:

Value has always been created from cool, but with the attention economy becoming more finely tuned, the narratives about what’s hot are globalized and instantly sharable. The wider the cultural impact, the higher the valuations.Constructing a Culture Asset Portfolio Start Early: Fanatical teenagers spend many more focused hours immersing themselves in their cultural forms of choice than on school work. What if they had the encouragement and focus to make it pay off? It could blow their academic careers and future work value out of the water. The hard part would be having conviction when making the stand against conventional wisdom. Step 1)

Buy collectibles of G.O.A.T.S (Greatest Of All Time) Below are some examples.

Sports

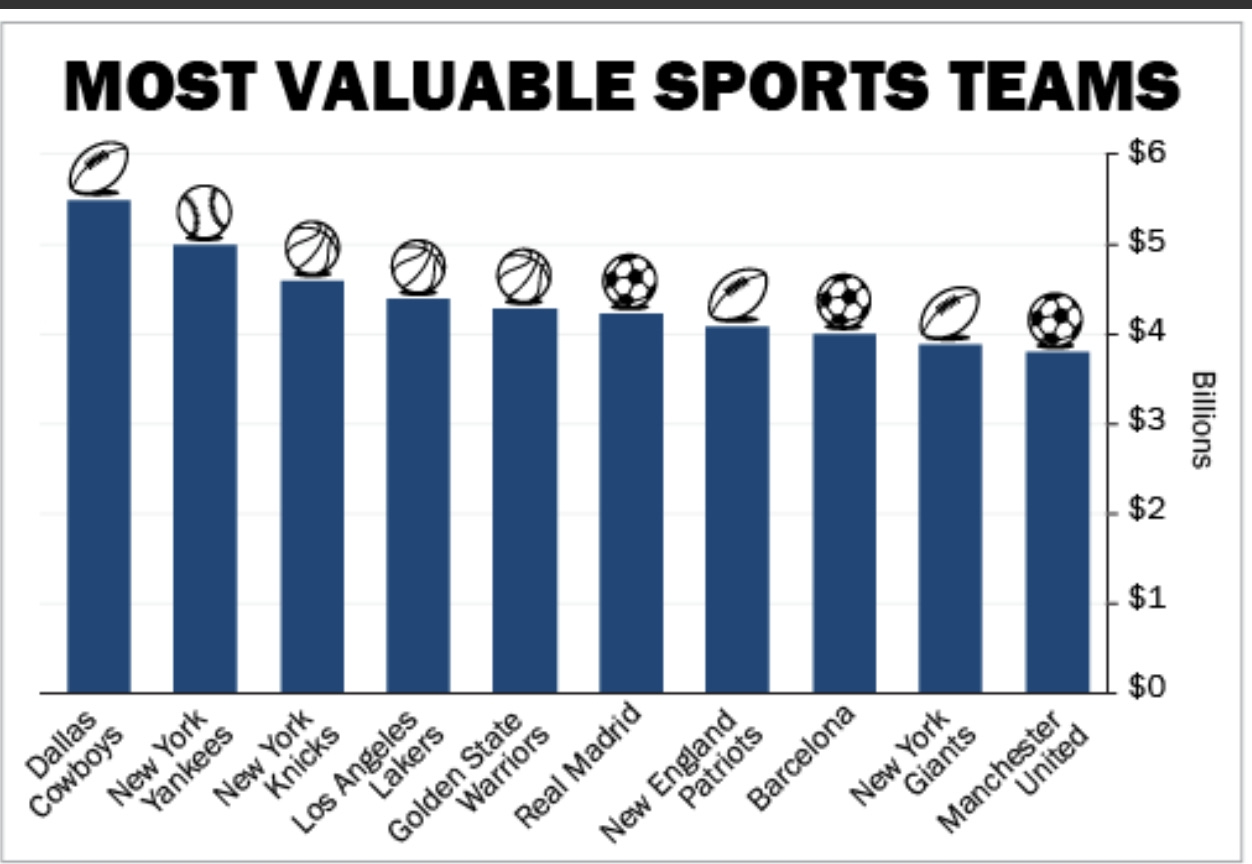

Basketball: Michael Jordan, LA Lakers

Football: Tom Brady

Baseball: Babe Ruth, New York Yankees

Soccer: Pele, Manchester United

Hockey: Wayne Gretzky.

Music

Hip Hop: Biggie and Tupac

King of Pop: Michael Jackson

Queen of Pop: Madonna

Rock: The Beatles

Country: Garth Brooks

Hard Rock: Led Zeppelin

Prog Rock: Pink Floyd

Latin: Julio Iglesias

Metal: Metallica

Reggae: Bob Marley

Jazz: Frank Sinatra

Soul: Stevie Wonder

Funk: Earth, Wind & Fire

Disco: ABBA.

Pop Culture

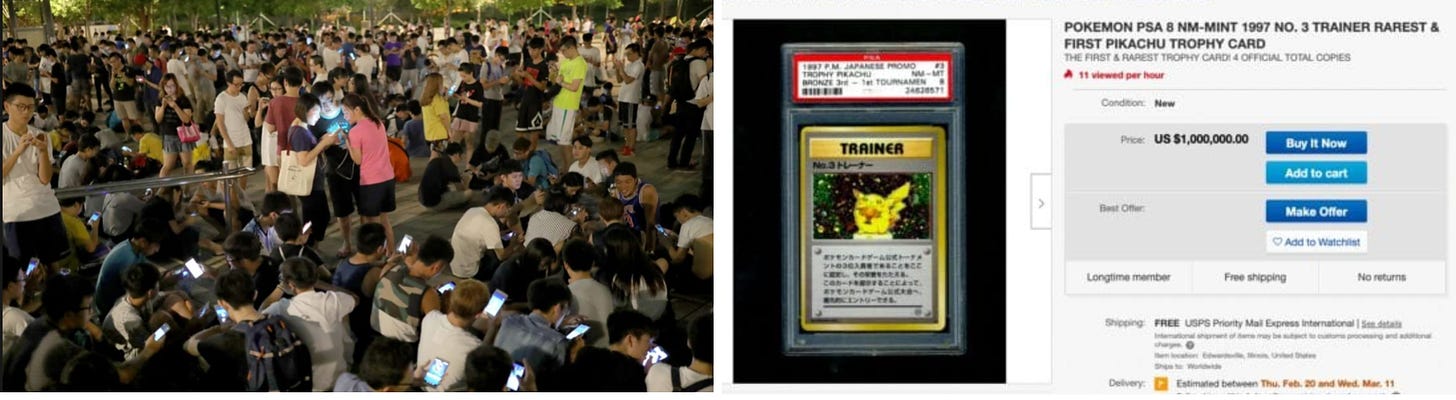

Anime: Pokémon

Drama: The Godfather

Sci-Fi: Star Wars

Fantasy: Lord of the Rings

Martial Arts: Bruce Lee

Action: Marvel & DC

Musical: The Sound of Music

Adventure: Harry Potter

Romantic: TitanicStep 2) Buy shares of streaming winners: Netflix, Spotify, Disney, Amazon, AppleStep 3) Purchase Intellectual Property (IP) & own Royalties Be prepared to do your homework to buy & hold directly. Or the recommended way: Get in touch, details below.Sound interesting?

These are the five major steps I used to build a culture streaming portfolio.

1. Sport GOATS: Building a Valuable Portfolio Early

At some point, during your lifetime you’ll probably regret getting rid of some of childhood treasures as you’d underestimated their cultural significance. Yes, those books, toys, models, cards, and comics. How could you have known they would have come to represent the stream of consciousness for a generation and become nostalgia infused cultural assets?

Master Pham`s fortune began when he was invited to take part in a lucky contest, with the grand prize of a hockey card. The only hurdle was having to roll six straight sixes on the dice.

Job done.

The prize card was none other than Wayne Gretzky valued around 700CAD at the time. Of course, returning home with the card warranted a photo opportunity. Fast forward to 2020, the same card sells for a record $1,000,000+USD. The symbol transformed into an asset, turning a children's collector item into tangible assets and wealth.

2. Trophy Asset Teams: Participation in Culture with Capital

Fans don’t just want to spectate, they want to speculate!

Take the harsh rivalry between Manchester United & Manchester City for example.

Besides placing bets at the bookies, fans are investing in a stock.

Right now Manchester United is in with a chance of winning the league after not being champions for the last 8-9 years.

Besides calling the stock, you are also calling their rise again in European soccer. Manchester United is one of the biggest teams in the world, with a legacy of representing soccer at the highest level and a successful franchise business model.

Man Utd Purchase Imminent

3. Hip Hop GOATS: Listen Up!

Music streaming companies and labels are buying up music publishing rights like an arms race. Hundreds of millions of dollars for the life’s work of some artists, like Bob Dylan who sold up for somewhere between $300-400million. Raises a lot of questions about where this is all going.

An interesting point cited by artists who are ‘cashing in’ now is the talk of estate planning. With the thinking that if capitalism is dead, might as well get out now before a new administration makes big tax changes. Besides politics, after the previous problems encountered in transitioning to digital formats with historic low valuations, it makes sense for older artists to sell up while the going is good.

Streaming platforms are also delivering a double whammy to bigger artists who have major record label deals. Independent artists can go directly to the consumer now, yes, the streaming rates are bad, but there is no label either. With the quality and necessity of home studios rising, artists can get in their own productive flows for creation, production, and release. In that sense it’s the smoothest it’s ever been. The tools and audiences for daily releases are here, allowing for prolific publishing.

It’s not only in the music world, Spotify paid $100 Million for the rights to Joe Rogan’s podcast. In terms of a medium, podcasts are still relatively new. But with their high engagement rates, affluent demographics, and emphasis on authentic connection, they are placed at a premium. 22% of listening on Spotify is to podcasts.

Spotify - leading audio streaming platform at a glance:

286 million users

130 million premium subscribers

Over $2.2Billion cash available

Share price up over 80% in 2020

Almost twice as many users as nearest competitor Apple Music

Buying undervalued content since 2018

5. Streaming Winners: Grab Popcorn & Watch the Show!

In recent months we have heard about how COVID has been an accelerator of change. It has forced business decisions that were previously unthinkable. Such as simultaneous releases on streaming platforms and at cinemas. Stakeholders across the board have been raising their concerns, some louder than others, like cinema creators whose blockbuster budgets and visions could only be justified and realized with the big screen.

Culture consumption habits are changing. There are still die-hard cinema experience fans, but limited options to attend in many countries. The extent to which streaming platforms are prepared to go is now being revealed. The range and quality are expanding with entertainment companies throwing in the kitchen sink in terms of new releases in an effort to provide added value and beat the competition.

Disney is leading the charge in content purchases and by throwing in Star Wars, Marvel, and Pixar to their streaming service. Membership numbers are already smashing previous targets, with new projections to exceed 300 million subscribers by 2024, making the cable TV incomes pale by comparison. Some companies have been slow to transition, in similar ways to how the music industry moved on from pirated access to utility streaming models 10-15 years ago.

Content creation budgets for streaming movies are now matching those of cinema. We have reached the tipping point of no return, Netflix, Disney, Apple, HBO Max, Warner, AT&T are at war. War against each other and themselves. Entertainment companies know it’s do or die, the coming months will show if their commitments to make it work will pay off or not. Long gone are the days of charging for individual releases or feature content, now all media is being bundled into all you can consume models. The winners will be the ones able to provide more for less with their membership deals.

Spending is leading the way, with investments into original content, IP and royalty purchases. The range of consumer spending is limited with pricing, so the battle is on for scale.

Netflix - Leading streaming biz at a glance:

Subscriptions reaching almost 200million, increasing over 28million in 2020 alone

Share price up 50% in 2020, over 1800% in 10 years

Over $8.4 billion in cash available

Consistent subscription price raises

Bought Netflix at $350

Bought AMC at $2.50 -$6.00

You need to be different.

Stop being a consumer and be an investor now.

Cultural Consumption v Cultural Assets

Culture is Money

Humanity’s stream of consciousness is cultural or collective thought. Cultural assets are a gateway portal to living out and participating in the culture, an act of living. It has scaled so effectively because it is based on the minds of each individual. Different segments of society identify with niche groups and have a whole range of ways to access and engage in the culture. The most attractive are desired by the highest quality demographic. Within the demographics, we can see the differences amongst class groups.

Lower and middle classes have no connection to high art, heirlooms, and the cultural investments of the rich. Sports collections are hobbies for the common man. It is not just sports; characters, cards, models, toys, you name it, there are maniac fans who will collect it and value it.

The value for these assets will ride on the wave of the streaming media platforms. Here are some case examples of content driving the culture.

Case 1: With the scale of media giants with budgets in the hundreds of millions of dollars, there are ever far-reaching cultural impacts of new releases. Take for example The Queen’s Gambit a Netflix original film released in 2020. Triggering an avalanche of chess sets selling out worldwide, the craze of chess has swept the world on the back of that release. Showing that a streamed release could have a cultural impact to match or beat some blockbusters.Case 2: Another example is The Last Dance, a documentary series based around Michael Jordan and the Chicago Bulls. Besides being a great partnership between ESPN and Netflix in terms of viewer popularity, it caused a peak of related sales. Nike Air Jordan’s sales up 90%, prices doubling on nostalgic collectibles, Jordan sports card’s sales up x 4 and prices doubling. All other sports card sales up 100%, not just in basketball.Case 3: In 2016, the top 10 grossing movies only had two new movies, with the others being linked to an older relative. 2018 movie Bohemian Rhapsody was a smash hit despite Freddie Mercury dying in 1991. Triggering the next generation of consumption for Queen’s music and solidifying their cultural significance for time to come.Case 4: Star Wars is another good example of cashing in on nostalgia, with seasons being released a generation apart and toys continuing to sell independently of film releases. Offering deep feelings of comfort, nostalgia is understandably appealing during a global pandemic. It enables us to control our own mental worlds and nostalgic culture provides a safe blanket of familiarity. Portable Wealth: Hard Assets Don’t Float my Boat

Do you like Portable Wealth? Compare sports cards to precious metals at the airport with scanners, declarations and taxes. Or think about the ease of stashing cards away at home without the need for external storage vaults.The gold & silver bugs and other hard asset holders are concerned for all the right reasons. The issue is that their conclusions about what should happen are incorrect. If there is no return to reality, how can you expect a return on investment based on a return to reality?

We too have been long silver, despite the fantastic gains of 45% during 2020, it doesn’t compare to IP purchased around the same time, which has performed X10.

Just think about all the country estates in England, illiquid, run down because of no revenues to sustain the maintenance. Unsellable if holding on to the family name, their status is anchored to their estate. Compare that to tech stock PE 100X. Before the great reset how did tech stocks do? If we are going to experience the biggest flood of fiat in history, doesn’t it make sense to build an ark that can float on the rising tides?

Omega Divide

The real economy is decoupling from the invisible economy. Old patterns of thought will not help us see the new opportunities arising in the abstract. We may have to put aside our prejudices and accept the evolution of tangible and intangible cultural values. 2020 also saw all-time highs of SPACs (Special Purpose Acquisition Companies) valuations and activity. Showing us that the money for investments is there, but the process of tuning in to choose the best opportunities is where the money is made.

Action!

If you are interested in making investments into cultural assets, please get in touch by replying to this email - serious contenders only, please.

For the backstory that led to these conclusions and us taking positions in these sectors, please see some of our previous work on cultural assets & commodities.

29 May 2020 - Flash After a Golden Moment

4 April 2019 - Building Your Own Content

14 March 2019 - Three Tips to Investing in Content Royalty Portfolio

15 Mar 2019 - How to Trade with the Trend in Commodities (Predicted +45% Silver)

12 March 2019 - The Silent Boom Understanding the Music Rights Industry

Interesting insights. Keep it up!