Twas the MoonFall before Christmas, when all through the house

Not a creature was stirring, a lockdown in your house.

The stockings were hung by the chimney with care.

In hopes that St Nicholas and consumerist subversions would soon be there.

The children were nestled all snug in their beds,

While visions of TikTok degeneracy danced in their heads.

And single mamma texting on her phone, and boyfriend in a cap,

Had just settled our brains for a dark winter of 'severe illness and death'

Merry Christmas!

PAY ATTENTION! What did I tell you?

First, I told you to ignore Evergrande and asked - if you got your Booster Stock?

All to SELL! Before MoonFall.

This is because we are going from Omicron to the Omega Point.

You must ESCAPE! The Prison Planet as things will get very INVISIBLE - META.

Yet, #DONOTSELL physical culture assets - MESA - as the Inversion of Energy takes shape.

Are you not entertained?

Know Yourself and Free Yourself

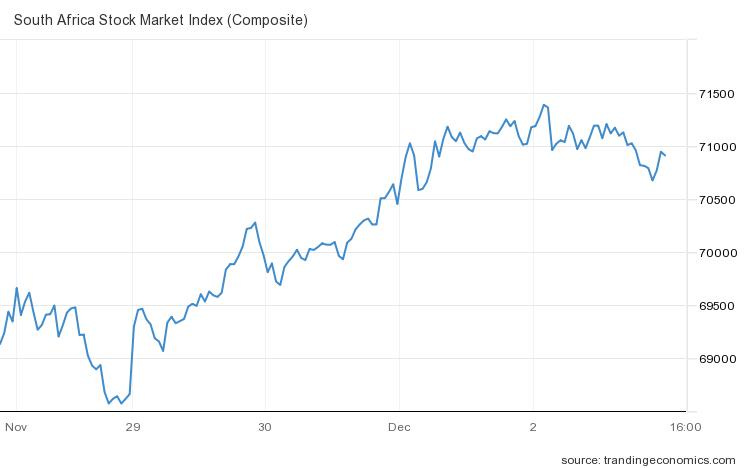

South African has a lot of problems.

The market reached all time highs after the news of Omicron breaks and you can see it has pulled back modestly.

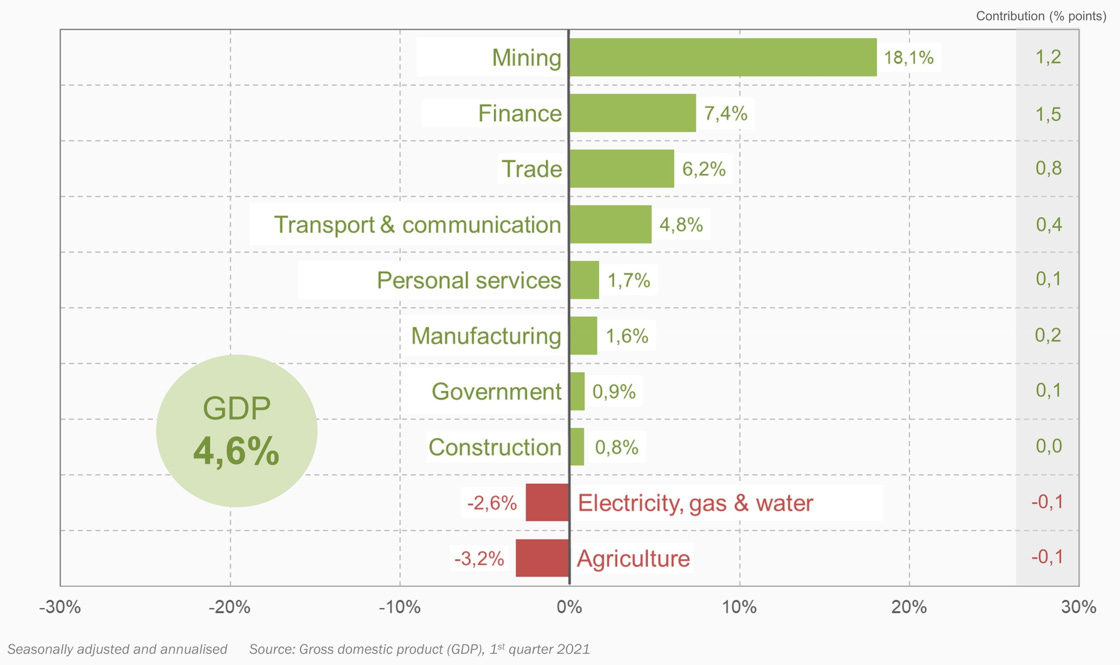

This would be great if it actually translates into tax profits for the government, who are desperately trying to pay down the national debt. Despite the Finance Minister vowing to avert a debt crisis, the market is the invisible mistress.

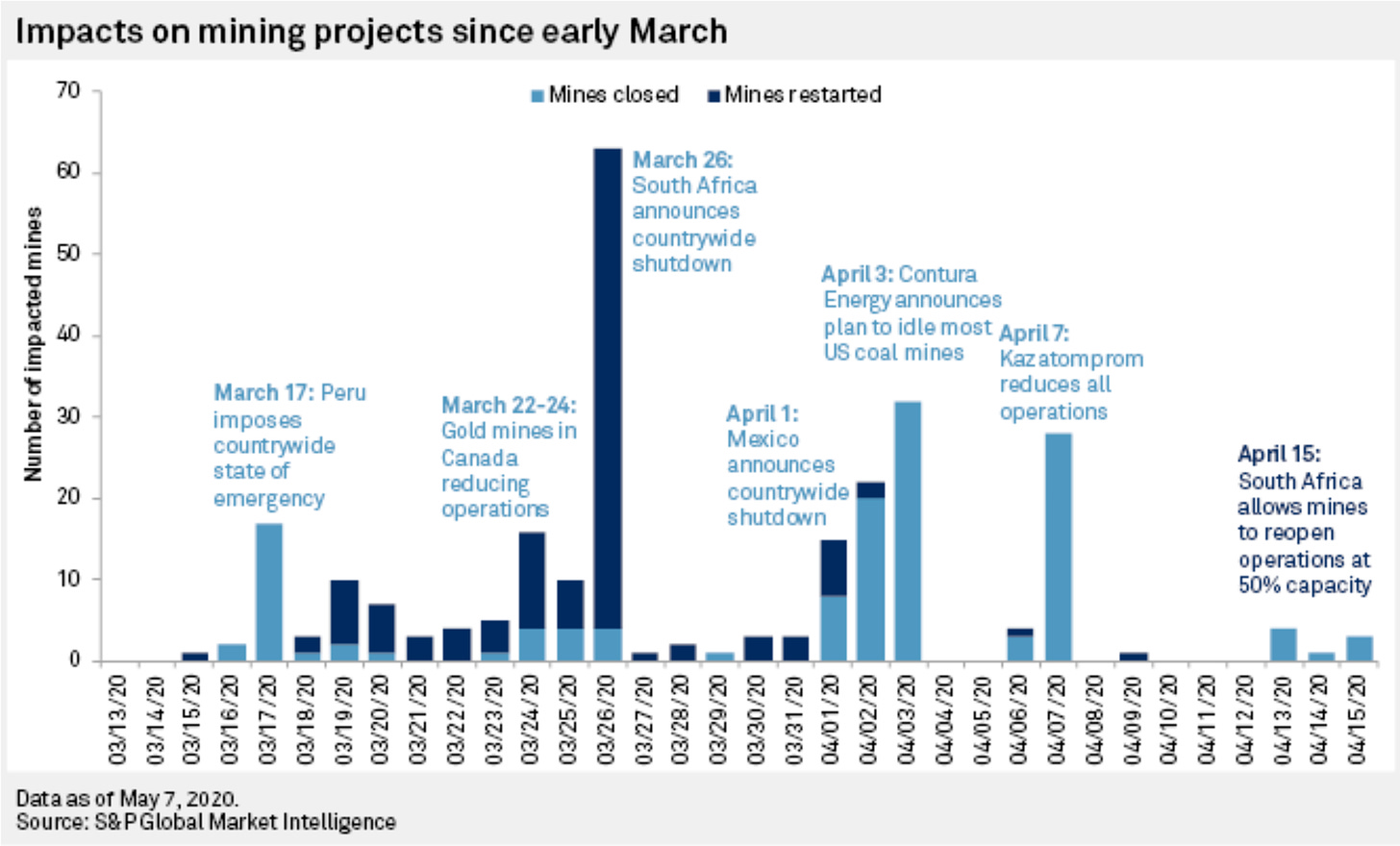

Gold Diggers

Mining is particularly vulnerable to COVID restrictions due to working capacity of workers in the mines. We have seen difficulties with supply chains, chips and logistics in the automotive industry.

Read more about the limits of logistics End The Tyranny

Although the riots in July 2021 were sparked by protests over the trial of former president Zuma, the people didn’t hesitate to use the opportunity to express all their grievances or just take the chance for looting.

Causing food, medicine, fuel shortages suspension of services and supply chain disruptions. Vigilante groups and the army were required for some kind of order to be restored.

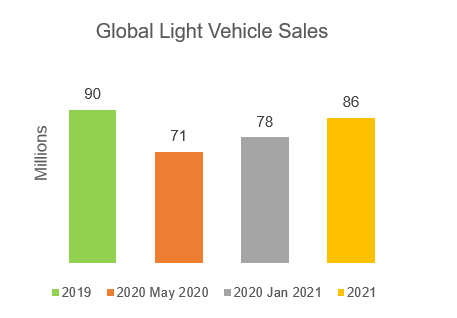

We have seen car production slow down with the chip shortage, in turn reducing demand for the platinum group.

This has meant that employers currently have the upper hand in the workplace, with unemployment around 32%. If demand returns and the tables turn, worker’s unions will likely return to making demands.

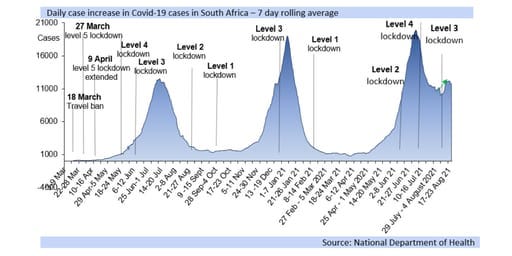

Alert Level 1! OMICRON STRIKES

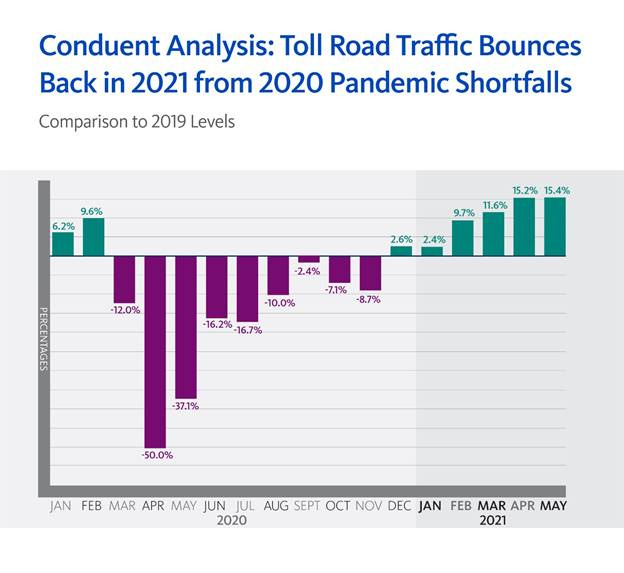

With travel banned from the seven countries of Southern Africa being introduced around the world, supply chains will begin to be affected with the knock on limitations of reduced air cargo.

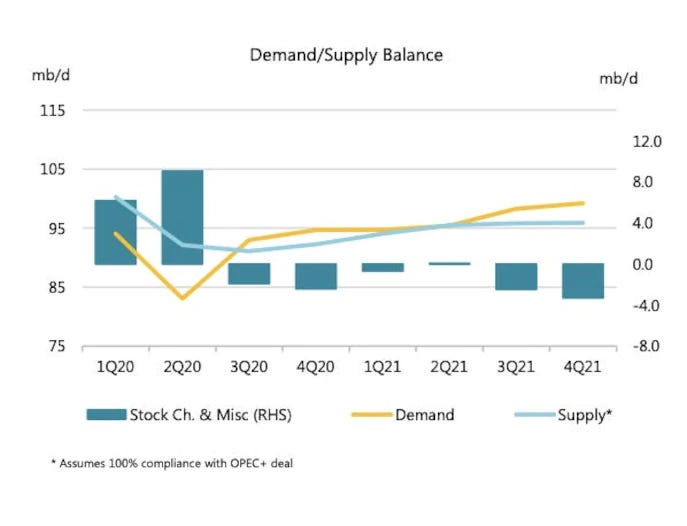

Demand

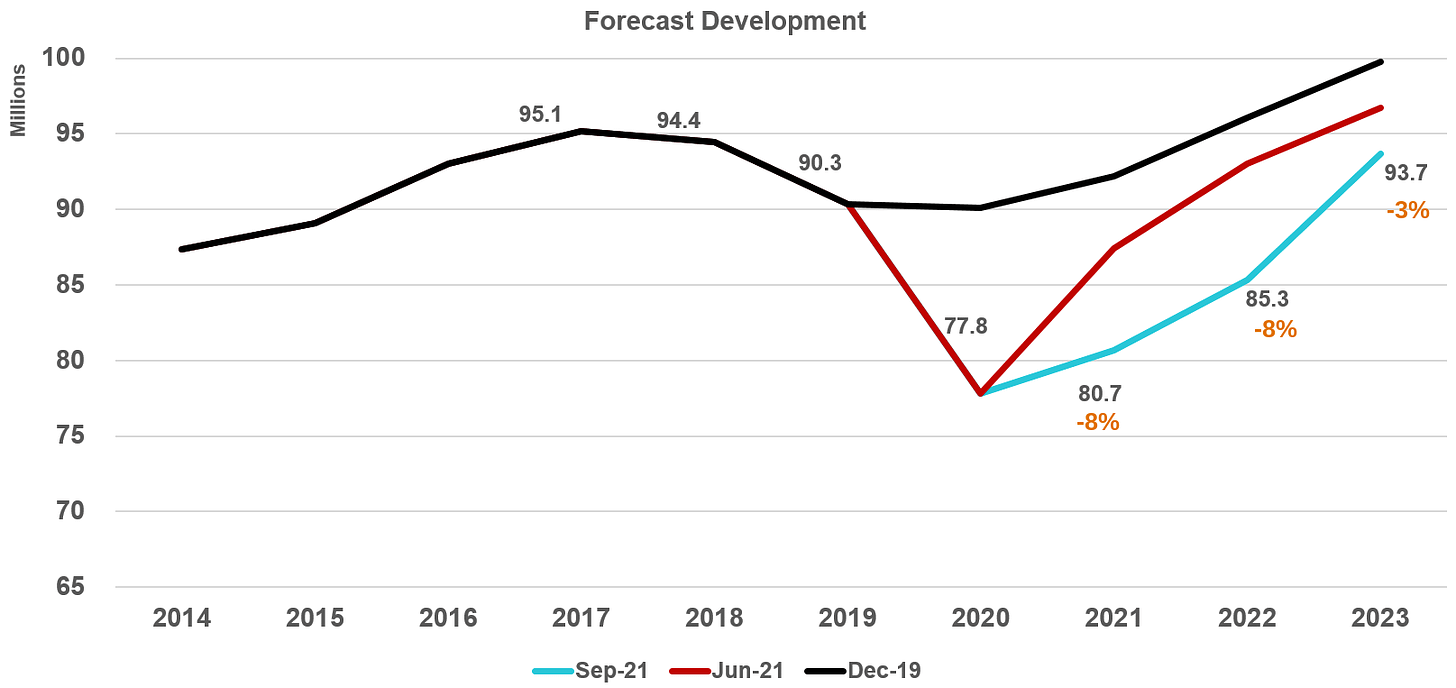

In 2021, we saw automotive production and sales returning, led by North America, Europe, Japan, China and India. Although we may see a further slow down with production due to Omicron restrictions.

The overall trend of increasing demand and a return of production where supply chains allow is evident. Platinum demand will continue as the eco drive to build EVs at scale continues. Palladium demand will continue to provide the cleanest vehicles with the oil based infrastructure.

NOTE: Even My Boring Calls Get +30% in a Few Months - Batting Avg.

BUY

Platinum Group Metals (PGMs)

Platinum Stop Loss $885

Palladium Stop Loss $1675

BASICS

Platinum: 40-50% of supply is used by the automotive industry.

This includes EVs. With industry and jewelry making up the rest.

Palladium: 80-85% for automotive use, mainly used for making combustion engine emissions as clean as possible using catalytic converters. It is not used in EVs.

SUMMARY

A domestic lockdown in South Africa could be the catalyst for mining limitations, triggering financial problems at home with a mining dependent market at all time highs. Sell offs could be the spark for a sovereign debt crisis, in turn impacting mining with liquidity problems. Also causing disruption in the wider automotive industry supply chain and ultimately consumer demand.

South Africa is unstable on several fronts, it is poised to have supply problems, leading to shortages and price increases in PGMs.

Do Not Forget.

There is exerting pressure on global equites into Q2 '2022.

If you are looking for investment analysis, please get in touch, let’s talk.