* Look at The Economist tackling the supposed “gap”. I encourage you mentally to pave roads to connect the two.

This is the end of the podcast trilogy.

I have been concurrently refining the precision of trades and developing major investment themes such as Omega Points.

You can see the development of this approach in the following sequence of articles:

This pursuit of Omega Points is not done! I have a few more things to say about it and that will be coming soon.

Additionally, there is a lot of things to share about commodities and credit cycles. I completed what Ray Dalio discusses but never fully put together.

When I looked at the History of Asia, I discovered that debt stimulus was necessary for the region's growth.

But when considering the breadth and scope of the type of stimulus needed on an international level, one must look at how these companies are raising their capital.

Specifically — are they raising capital from local commercial banks, or are they raising from equity markets?

Where is the source of the capital? Is it international? Or on a domestic level?

And how do these questions factor into globalization?

Well, as we develop our approach and models, we must account for both local and global factors, including the capital that is getting funneled towards these companies and political machinations.

Our CDI and ACD models focus on this very idea of globalization. Essentially, the idea of export discipline, where the government provides stimulus to companies to foster the export industry.

With CDI, we seek to capture two major factors — debt and investment both locally and internationally. Because debt and credit can be tracked irrespective to globalist perspectives, our ability to capture these trends are unaffected.

In other words: when creating a theory of model, it must be durable, despite all other inputs and variables.

I hope you enjoy it!

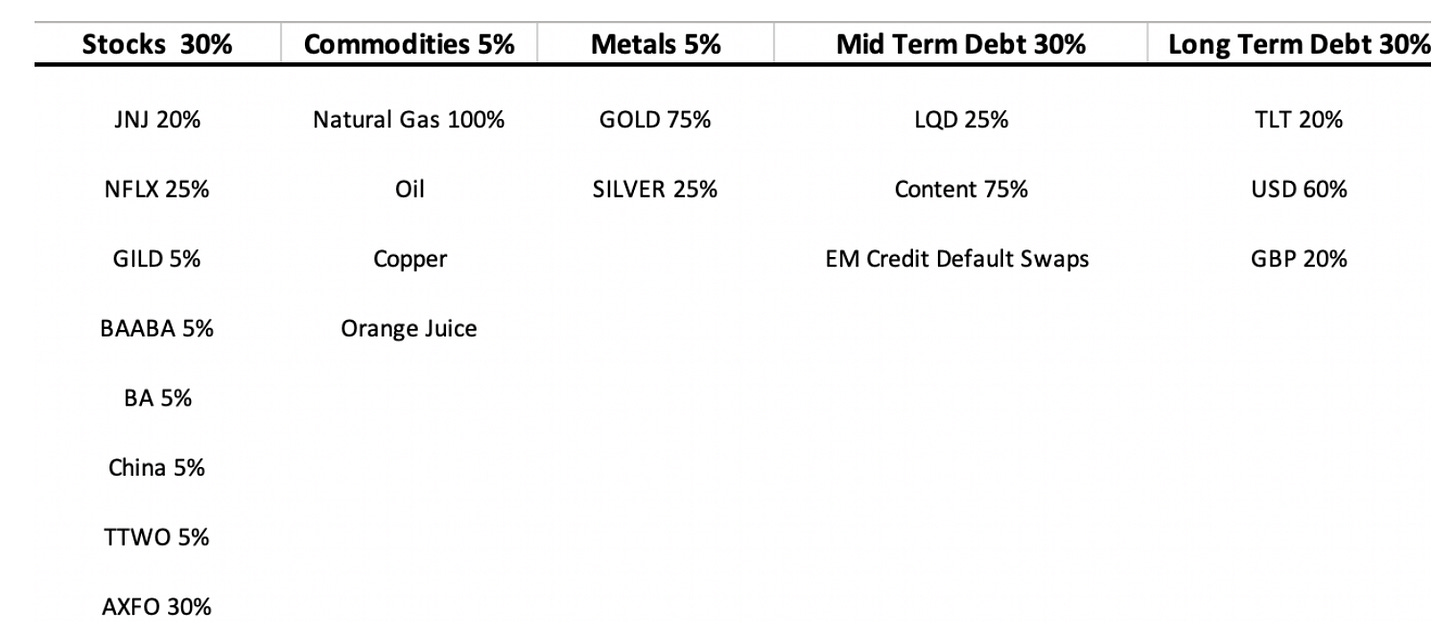

P.S Here is portfolio since April 25th

Confessions of a Fund Manager III