Russia's Great Wall of Deception: 'Zapad' Fire

WARNING: The following will unveil how Russia and China are working in tandem on a long-range dominance strategy, to tame & centralize the West with the end-goal of global social and economic convergence.

Investors are advised to capture the trend of non-democratic transnational state capitalism. In order to follow the fiat money, we need to follow the debt.

Zapad, or Exercise West is what Russia and former Soviet states call military exercises directed at NATO. Sun Tzu, wrote that the best wars are fought without actually fighting which is essential military doctrine for the Dragon and the Bear.

These actions are a part of an ongoing full-scale secret, a Great Wall of Deception designed to destroy the west through fractions and convergence.

Let’s check the facts:

- The United States invented HIV/AIDS in 1960…

- CIA was behind the assassination of JFK.

- Trump is a Russian stooge.

Which of statements are real? Or is this all part the long-range strategy for dominance, all part of an “active measures” campaign designed to confound, confuse, and divide following a very simple KGB formula:

1. Find a crack

2. The Big Lie

3. A Kernel of Truth

4. Conceal Your Hand

5. The Useful Idiot

6. Deny Everything

7. The Long Game

Dezinformatsiya or Disinformation can be traced back, in some way, to the security apparatus of the Russian state.

What if The Great Wall of Deception’s subversive influence runs deeper…

To the thoughts and ideas that you have, and that surround you, every day?

Is it not more natural to seek a higher authority than it is to be liberated? What is the price for both? Nothing is free.

But first, let’s take a step back and understand the context.

The Authoritarian Lifestyle’s of the Rich and Famous

There is one underlying dispute between the dragon and the bear in the past 70 years. Who would reign supreme in drive towards global convergence?

Yet in the last two decades, the Sino-Russia relationship has evolved...

They are now united and stronger for it.

Russia learned from the success of the Asian Capital Developmental model, economically repositioning themselves globally and growing beyond the shame of the fall of the Soviet Union.

China, known regionally for deceptive warfare, such as their annexation of Tibet under the guise of the Korean War outflank, and the industrial reforms and disbursement (San Xian, or third front) in reaction to the Vietnam War.

Yet, China gained from the Soviets the ability to act globally via active measures, to spread influence and enshrine their position as a global economic superpower.

These two countries are expanding their integration on an economic level, including pushing forward the Belt and Road Initiative and the Eurasian Economic union.

And as these nations grow, the leaders reap the benefits... making their leaders Xi and Putin two of the richest and most famous people in history.

A Web of Control

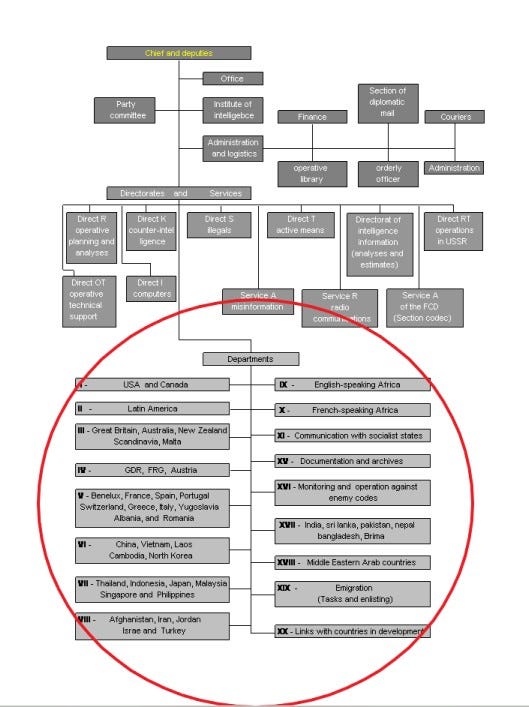

In order to understand the Great Wall of Deception we need to go to its roots — inside the KGB.

The KGB allocated 75% of its budget focused towards subversion. In Russia, 64% of the people are disinformed, dreaming of the days of the Soviet Union.

It may be closer than you think.

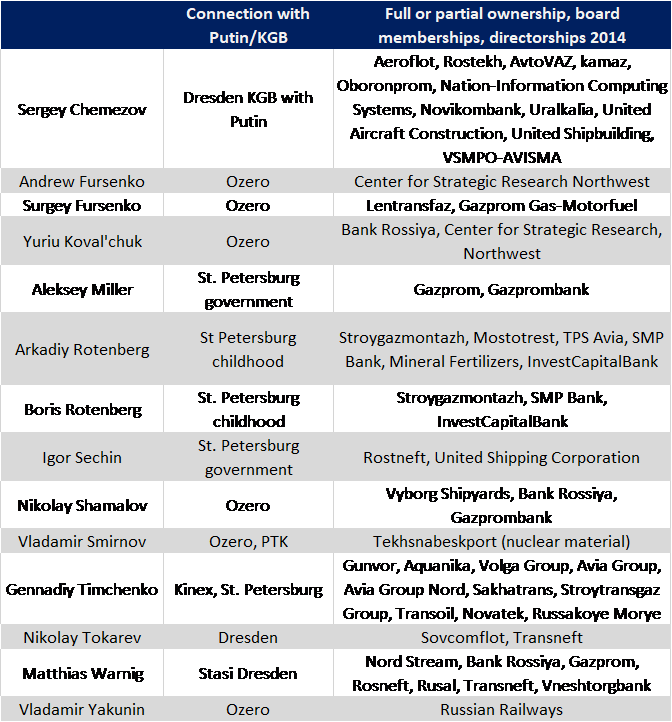

Putin merged the FSB with Russia’s foreign intelligence service (dubbed the Ministry of State Security, paying homage to Mao’s mentor Joseph Stalin’s Secret police).

This 250,000-person strong agency will be as large as the KGB, and a quarter of the size of the Russian military.

The reborn KGB regained control over a huge swath of the Russian government, as Putin’s inner circle began their takeover of every institution of state and Russian businesses.

But in a time when State Capitalism is king, Russia and China has learned that expansion of their Sphere of Influence via corporate infiltration (often into other nations…) is a key weapon in global politics.

The massive state oil conglomerate Rostneft has subsidiaries all over the world, including former and current communist countries.

Gazprom, another massive Russian Oil SOE, has an even larger subsidiary presence in 38 countries, 18 of which are also former or current communist countries.

Russia is spreading their corporate influence throughout the globe, tying these nations together on a dependency on both an economic and resource basis.

This is similarly mirrored by China’s Belt and Road Initiative (and related Bamboo Network) as well as their infrastructure and financial support in Africa and other Asian nations.

The two allies are working to support global convergence, eliminating all economic disparity and fusing together the nations of the world under their social systems.

Spreading the agenda via Infiltration

China and Russia have learned from Lenin and his predecessors, and quite evidently fully understand that the West can be infiltrated via soft power initiatives, cultural infiltrations and covert manipulations of the public conversation.

It is the personification of the new-age weapon of war — “disinformation,” a derivative of the name of a KGB black propaganda department.

KGB defector Yuri Bezmenov warned the United States of disinformation, stating that 85% of the efforts of the KGB was focused on active ideological subversion measures.

Here is his claim on the timeline, mirroring the steps for “active measure” tactics.

1) 15 – 20 years to demoralize a nation, exposing a generation to Soviet-centered ideas

2) 2-5 years of economic and societal destabilization

3) 6-week crises

4) Normalization period

And now, it has evolved. It is no longer communist-centric, but instead autocratic-centric.

The Largest Intelligence State

One of their new weapons of this shadow-war is the Internet Research Agency (IRA), a Russian government-led company that engages in online influence operations.

The IRA’s main goal is to spread derision and divide the people, the heart and lifeblood of a democratic system.

From anti-immigration groups, to the elections, and Tea Party activists, to Black Lives Matter, the IRA has been involved in nearly every part of the national conversation.

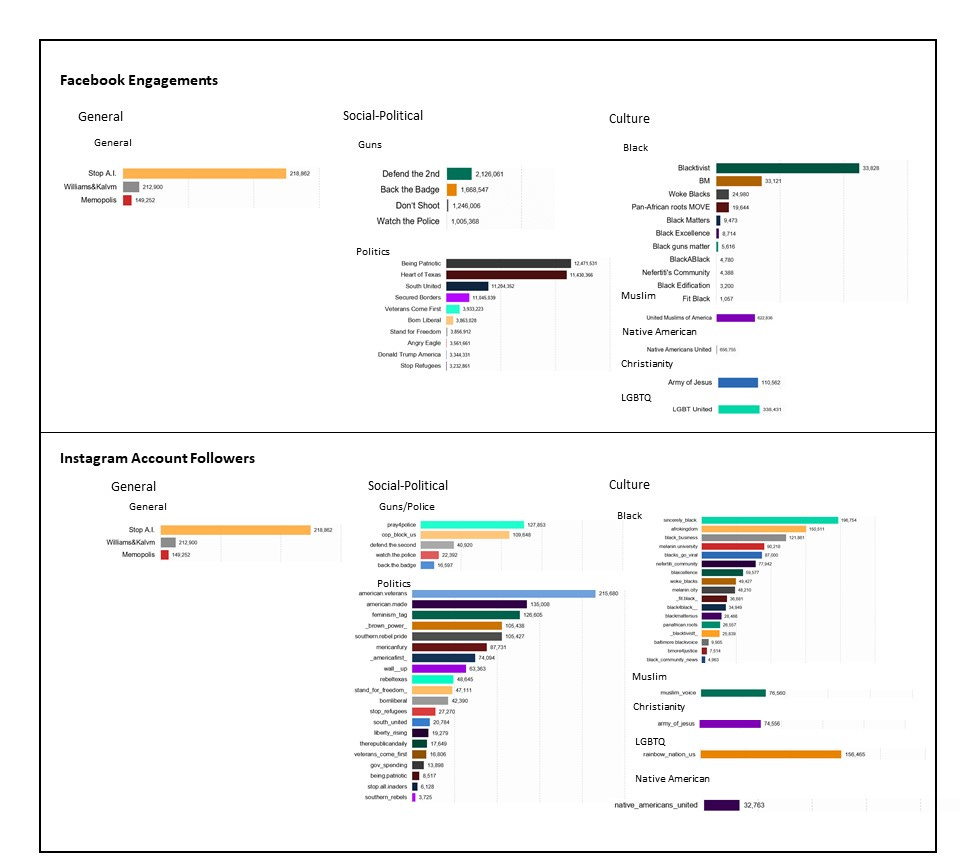

According to the infamous Mueller Report, the IRA has been confirmed to have spread across many social networks, including:

- 10.4 million tweets across 3814 twitter accounts reaching about 1.4 million people

- 1100 YouTube videos across 17 accounts

- 120,000 Instagram posts across 170 accounts

- 80,000 Facebook posts across 470 pages, reaching as much as 126 million people.

This totaled to about 77 million engagements across Facebook, 187 million on Instagram, and 73 million on twitter.

And this is just what we have been able to prove.

IRA’s goal has not been to strong-arm the United States’ political and social discussions, but instead subtly guide them, feeding people’s anger and frustration to meet their own self-interest.

The seed they needed to draw their lines in the sand.

Even more nefarious is the IRA’s main influence targets, focusing strongly on non-dominant culture groups in order to influence the possible “dictator vote” as described by economist Kenneth Arrow.

If they could change the perspectives on just a few of these groups, Russia has the potential severely influence the outcome of any democratic process in the US.

Centralization

The goal?

A consistent shift of control between the two parties in the United States, as when the Republican and Democratic parties are, at their very root, only small diversions from the center…

Then gradual expansive centralization occurs.

Followed by social and economic convergence.

Government size increases as more initiatives are enacted and more money printed to support them. But it is far easier to throw money at an initiative, than it is it take it away once it has become reliant upon it.

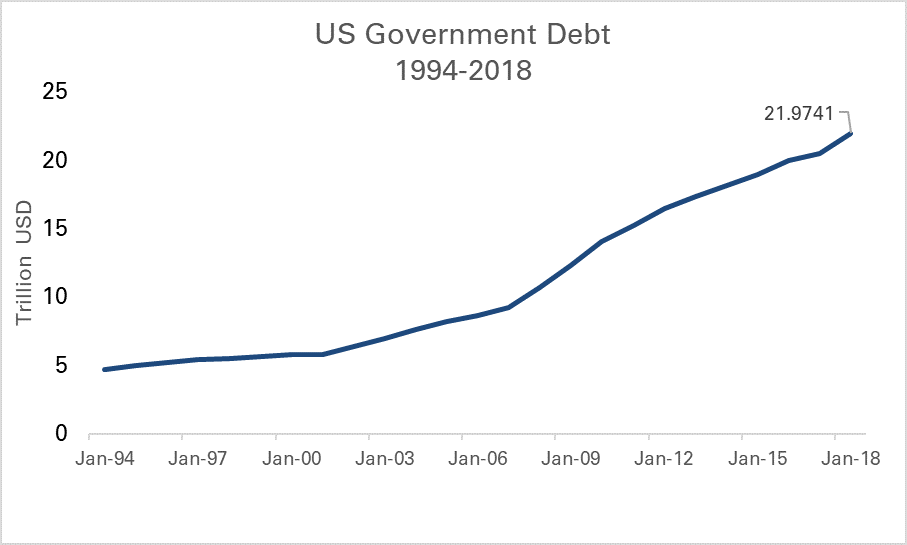

As this continues, year after year, the government only continues to grow.

And with growth comes bloat.

Governments across the globe will become so large and interdependent that it becomes their best interest to merge together.

Take the EU, APEC, the SEA, and the African Union... All intra-state apparatus’ that seek to combine similar governments together, for the betterment of all members.

And the is even further exacerbated by non-state initiatives such as the World Bank and IMF.

But what is the primary goal for China and Russia, besides the transfer of the power from West to East?

An increase in autocratic governments in the world, with them directly at the center.

China is growing its feared bamboo network into something formidable, as nations like Iran seek to join hands in corporation with the new China–Russian alliance.

Their goal is clear — power can easily be shared by a select few with similar ideals, and it is far easier to manipulate a few individuals than it is to manipulate an entire voter base.

Profiting from Centralization

Once we understand how the world works in between the black-and-white borders, we can begin to harness this information.

The exacerbated expansion of debt will continue with greater social economic convergence.

In China, economic growth has been slowing, and China will be forced to cut lending rates, interest rates, and reserve requirement ratios to help support their economy.

What does this mean? More debt.

But where should you look if you’d like to benefit? Government and corporate bonds. Notably the five- and ten-year maturities.

As governments tend to centralize, companies and bonds that are tied to the central powers-at-be reap the benefits.

You need to be aware of developments that affect these major players.

The same can be said for the USA.

Or any converging state, as…

Convergence is total and equalizing.

And Converged systems are too big to fail.

Here’s an example for you:

Due to fears of lowering fed rates, we made a call was placed on 10-year treasury bond futures from May 24th, a savvy investor could have realized a 400% return…all in less than a month.

Why active fixed income management wins

Investing in the stock market and in bonds involves two very different mindsets.

In the stock market, investors tend the be very active, as they understand that the dynamism of stock prices is how they make returns.

If they believe the stock price will increase, they will invest in stock to yield a significant return.

The bond market is quite different. Well-rated bonds, such as government debt, allow investors and institutions to passively yield a small, yet safe, return.

Only a very small number of investors are active.

But what if you could actively trade in the bond market?

Bonds are representative of debt, be it consumer or government, and are attributed a rating according to their yield percentage and safety.

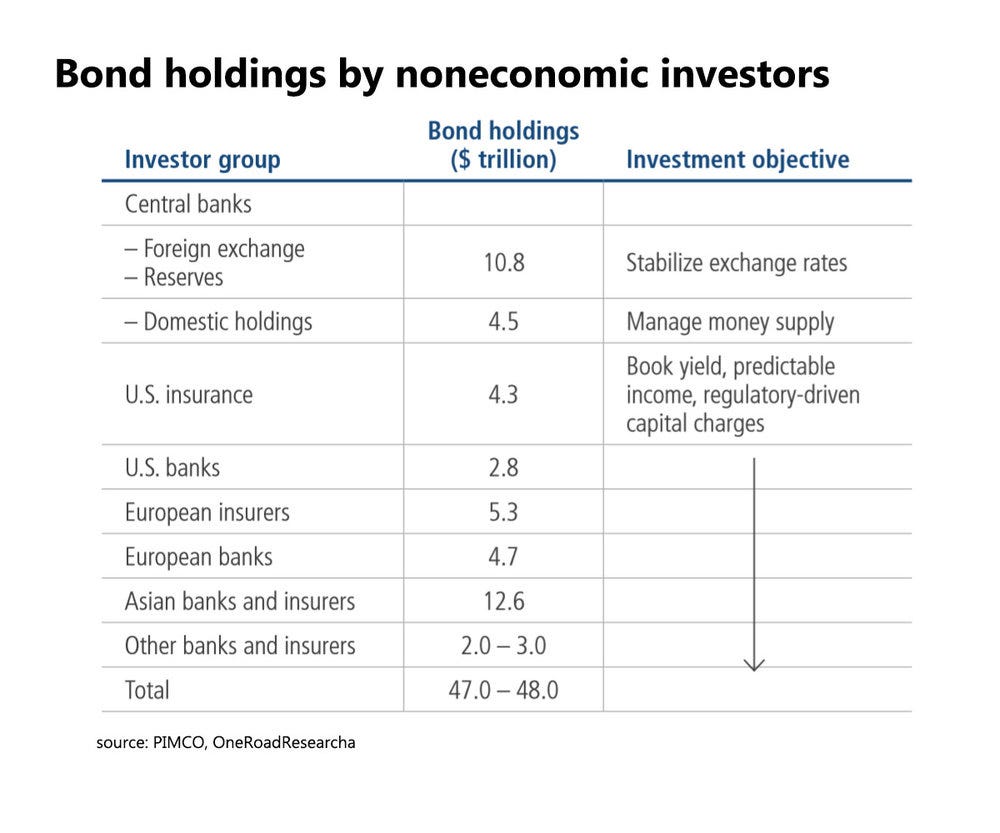

Regulatory bodies become involved to ensure that debt, which the entire financial system is built on, is properly supported. These regulators release requirements for institutional investors, stating which rated bonds, and in what volume, they should purchase. These tend to be large, highly rated products.

These are passive investors looking to place a large amount of capital into a safe option. These groups can’t afford to lose money, because if they were losing on the investment, it would mean financial ruin.

This was the foundation for the financial collapse in 2009.

This is further exacerbated when centralization occurs and government size increases. As governments have to pay for more programs, debt expands, more bonds are issued, and interest rates lower (due to the tax payer having to support the debt).

Regulations will increase as reliance on debt skyrockets, and institutions will have more opportunity for passive investment.

Yet those who do not fall under the regulatory stipulations —private investors, hedge funds, and individuals — can take advantage of this by being active in the market.

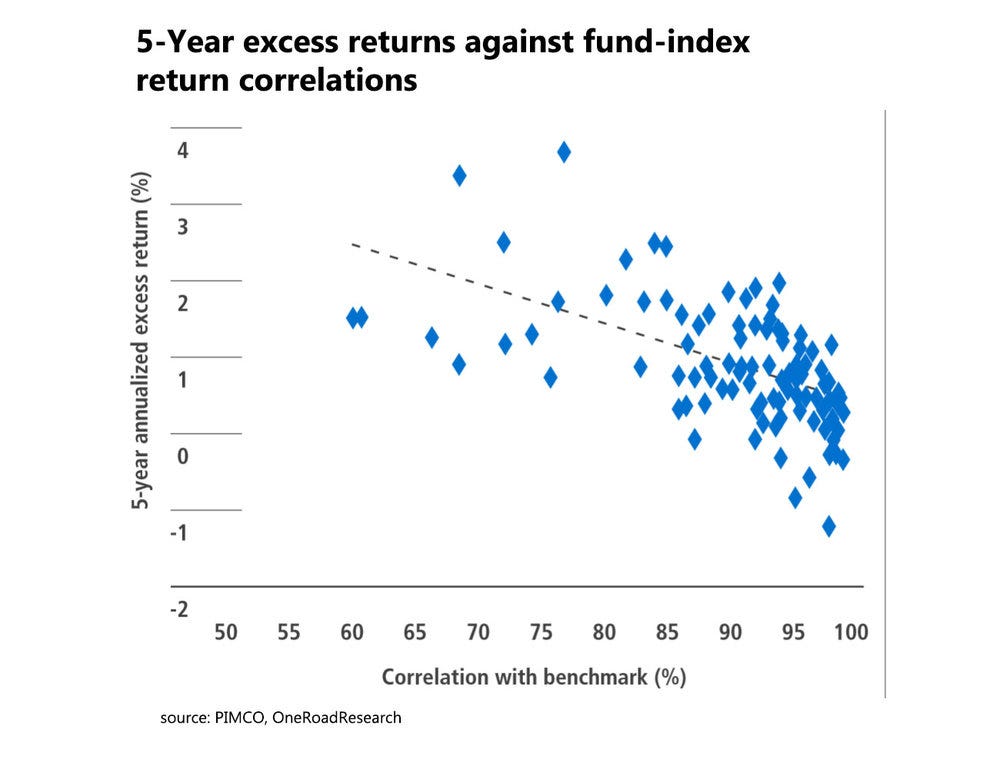

With the correct research and understanding, they can, and have, outperformed the market.

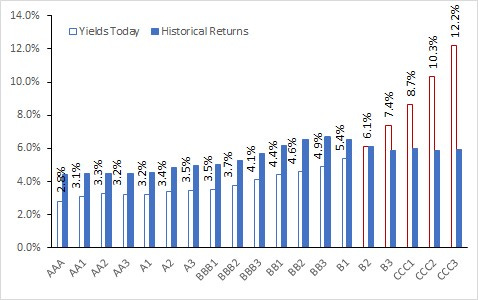

The solution? To focus on the bonds that diverge slightly from the “safe” A+ bonds.

Historical returns for all A-rated bonds range from 2.8 – 3.5%. Yet all the Bx bond show an increasing return rate higher than all A-rated bonds.

The sweet spot? BB3 bonds show to be the better historical return at nearly 5%, before dropping off in the B2 bonds.

It is up to you as an investor to take advantage of the inefficiencies in the bond market that are created by the large dumping of cash into safe, highly rated bonds.

It is up to you as an investor to take advantage of the inefficiencies in the bond market that are created by the large dumping of cash into safe, highly rated bonds.

Remember that within the capital structure, debt is first priority. With CDI, we track debt impact on equity performance with the balance sheets of corporations and find there to be a lead time of 12 months.

If you keep a watchful eye on what the big players are doing passively, then you can take advantage of the very same system that China and Russia are seeking to establish.

As a final send-off, I'll leave you with a video Yuri Bezmenov as he explains his warning to the world.

Don't ignore his message.