RIOTS EXPOSED: Class Warfare Setting Markets ABLAZE!

The Diverging States of America, Converging to the Omega Point!

WARNING: The words you are about to read will change the way you see the world. They reflect a technocratic agenda that is currently the pillar of our civilization. As you read on you will experience a veil lifting and find illumination to the world and its inter-connectedness with finance. Reject the social engineers, the mad scientists, reject the social unrest. Look at the numbers! Share this message with friends and loved ones. Get ready for the Omega Point!

Wool is being pulled over our eyes…

There are almost 36 million Americans without jobs. That’s 1 in 10 people.

Tensions with China are at historical highs as pledges to trade agreements are not being upheld.

Major American cities are burning and beset by violence and mass looting.

There is continuing civil unrest. This has spread to other societies, eg Auckland, New Zealand.

A pandemic without cure continues infecting an increasing number of Americans. So far 2 million people and counting.

The situation is dire, yet stock markets are rallying to all-time highs!

Will you see it and still not believe it?

Or even without seeing it, will you believe it?

Knowledge is Obsolete: You Have No idea

Is it not clear to you yet? On one side of the fence, despite all negative circumstances, the study of disease analysis is thriving. The virus is thriving. The stream of ‘consciousnesses’ through the financial economy, thriving!

Thriving in the US stock market.

Thriving in China’s stock market.

But especially thriving in Sweden's economy!

On the other side of the fence, many of the ‘too big to fail’ institutions we consider indestructible are fracturing right before us. The system is on its last legs, accelerating to breaking point, to the ‘Omega Point’. All that stands left of the empire is a myth of an emperor wearing no clothes. We cannot see him but still, we cannot dismiss his omnipresence. Why? This is because the economy has manifested into two states, the ‘real’ economy and everything else. Yet, it’s not so real - compare the following ‘objects’ to the following subjects:

Circulation v. Physical

Physical v. Total

Real v. Fiat

Wages v. GDP

Poor v. Rich

OBSERVE: all supposed ‘real’ objects are economically smaller than the subjects. The financial economy is bigger than the ‘real’ economy. We need to accept this reality and make the most of what is dealt. This is no time for social justice, this is the time to elevate your mind to the new paradigm shift.The Mad Scientist: Frankenstein; or, The Lab Pandemic

To gain a shift in thought, we need to stop outsourcing our thoughts. Take solace in the fact that very few know what they are doing. The experts or social engineers we have been reliant upon and listening to can never deliver real truth and certainty. This is because they base their knowledge and teachings inherently on a succession of provisional theories. Theories can be overturned at any time by new experimental data.

Social Information

COVID

Climate Change

Elizabeth Holmes

Eugenics

These models based on ideas of validation and falsification. When you mix these flawed models into the real economy, you undermine it and the damage begins! The misinformation invades:

our stream of consciousness

the cloud of technology

the material world

“Moore's Law of Mad Science: Every eighteen months, the minimum IQ necessary to destroy the world drops by one point.”

We cannot see it. We are lost as we cannot decode the hard truth. We cannot escape the reality we have collectively manifested.

Financial Alchemy is a Hard Asset

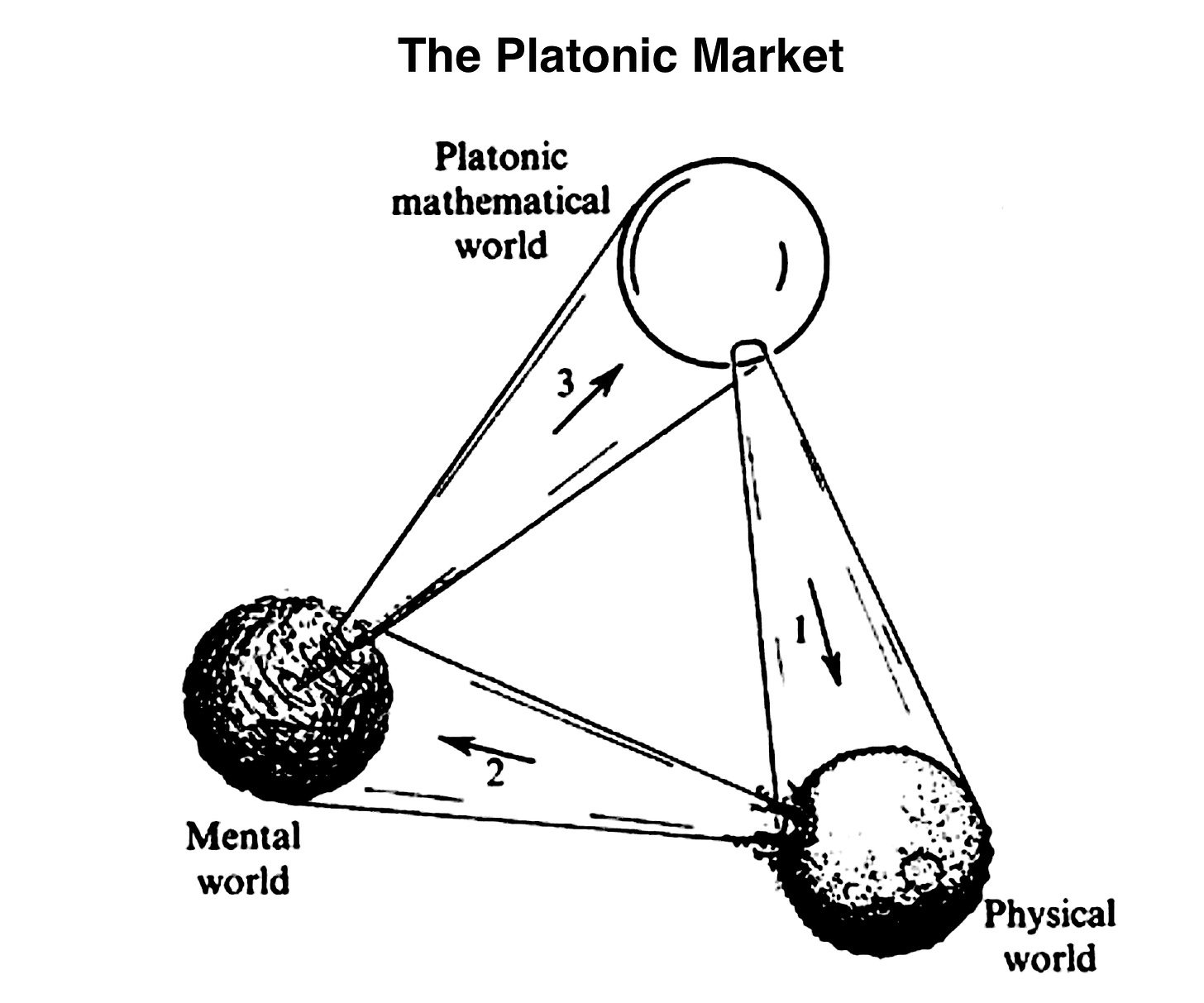

Understand, the financial economy has real-world implications. Decoding it is difficult. Breaking it is difficult. The only real solution is quite simple… mathematics.

Like most of the universe, the economy naturally refutes science. It is not observable by the eye, yet understood by the mind.

The abstract world must be measured and dealt with by mathematics. Math transcends us.

Its analytics are absolute. Its rudiments are entrenched as much as the Universe. This unarguable certainty is the substructure of design and creation (something science often attributes to the creator). Patterns and designs come preloaded, already embedded in the system. Like the numbers inside the chart patterns, we use to guide us.

“Those who are seeking the strict way of the truth should not trouble themselves about any object concerning which they cannot have a certainty equal to the arithmetical or geometrical demonstration.” Descartes

These designs represent mathematical symmetry. That is objects or solutions that look the same after specified changes are implemented. This takes the investor closer to the first principle of truths. Mathematical symmetry warns us to be cautious of overusing models. Particularly in finance, as the data used to formulate them are asymmetric, these models overused eventually also become asymmetric. Once this happens they are rendered impractical e.g LTCM

Ask Warren Buffett.

Provisional cash-flow models are an extrapolation of demand, as they assume that current trends will continue. But when the kinetic energy of demand is gone, there will be no cash-flow model - asymmetry.

*Only models and their hubris would attempt to project airline revenues 3 years into the future - Aswath Damodaran would agree.

The only thing left to do is measure the emergence or submerge of fiat money and ‘demand’. That is, closing the gap between real economic demand and real financial demand. Closing the gap between the bid and ask. Ultimately, closing the gap between real price and valuation.

Simply put, Warren Buffett wins because he is invested in the greatest 'financial economy' that the world has ever seen, rarely stepping out of reality. Any ‘wannabe’ imitations of his value models in repressive economic systems generally fall short. Do the math, not the model.

The Ontological Economy - It’s Real

Mathematics is

the queen of sciences

and arithmetic is

the queen of mathematics.

Johann Carl Friedrich Gauss

Founded on numbers, Mathematics is not an abstraction. It is the ontological state. It is reality.

Numbers are real things. What holds equal in the mind and equal in the observable world? Only numbers. What is the consistency between the financial economy and the real economy? Only numbers.Sir Issac Newton used this numerical or mathematical reasoning. Enabling his imagination to venture across space and time without a Falcon 9 or DMC DeLorean. Calculating gravity on planets, comets, and other objects in the universe and matching them up with the most accurate observations.

Once you deduce efficiency and layers from the game of finance (or most others), what remains is just a mathematical edge. This can be observed in:

Stock Markets: Game Theory

Chess: There are 288+ billion different possible positions after four moves

Poker: 2,598,960 combinations of 5 cards can be drawn

Business Analytics: Probabilities

Big Data: Probabilities

Digital Marketing: Sales Funnel Ratios

AI: Probabilities

Sports: Statistics

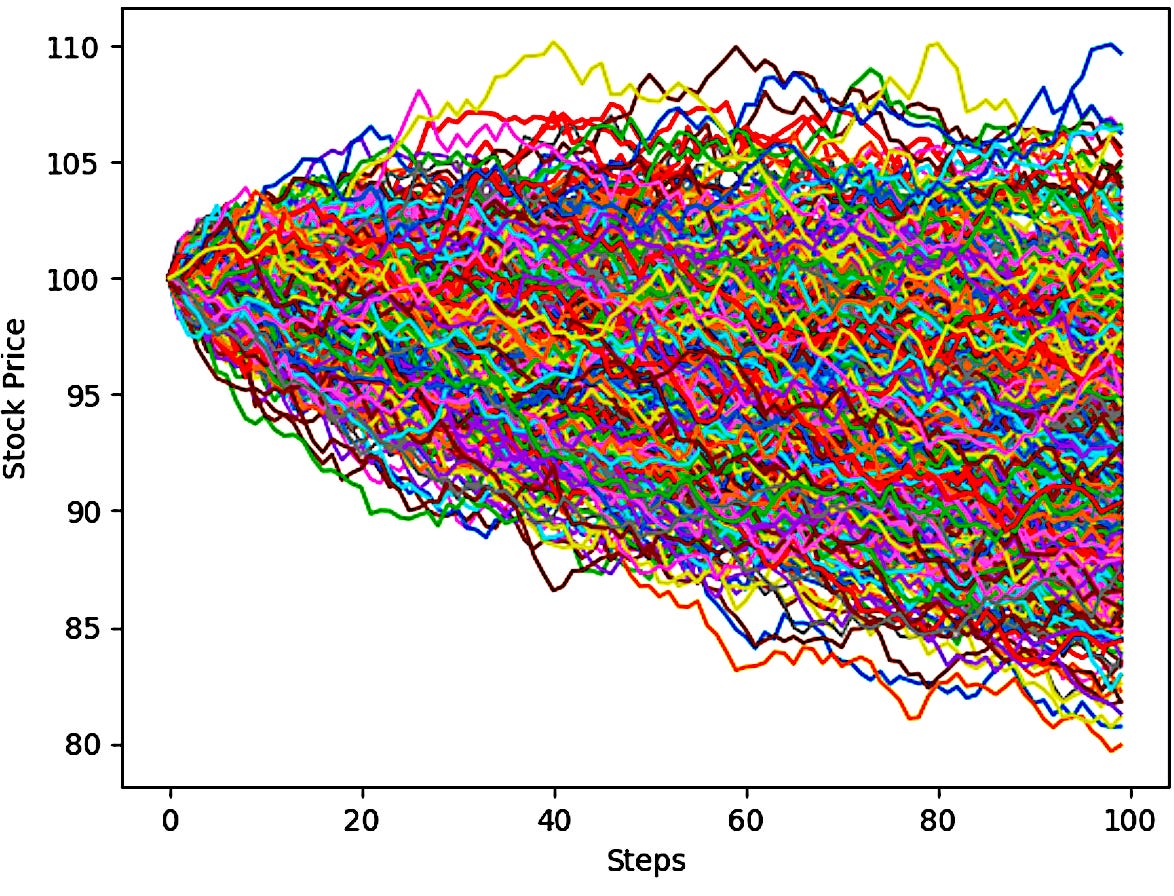

In the game of the stock market, there are only so many parameters that exist. Therefore there are only a limited number of plays that can be played. Just as in poker, only through understanding these possibilities and statistics, we will be able to mitigate risk and make plays that favor us.

*Each step or tick presents new premutations for the stock price

Basically, it comes down to this. The game of finance is designed Mathematically. Only through using math (numbers), backward-engineering (end game), and today’s computing systems (another series of numbers, binary 1’s and 0’s), then we’ll have a chance to win this game of numbers. This feature of the market will outlive any fad model of the day. Since it is the very nature of the market itself.

We must fight numbers with numbers! (Old Vietnamese proverb.)

The Ontological Economy will allow us to accept and measure the $100 trln global financial economies. Something that we cannot observe nor should we model. As in science, the sensory subject requires reality or the real economy to be sensory. Yet, it fails to capture the fact that we live in a non-sensory mathematical universe of a collective mind link. It is this disconnect that causes 99% of the population to comment on the divide of the stock market going higher as a pandemic and social unrest escalates.

NOTE: The 99% need to transfer its level of conviction for social justice to buy the Nasdaq, as buying the Nasdaq is equally comparable to social justice - George Soros would agree.We need arithmetic and geometric demonstrations in the Ontological Economy, not models.

The Hard Invisible Truth

Where to start? Look at the origin of the system or post the Omega Point.

This origin of the system starts with fiat money.

The fiat money within the total economy you are participating in.

Part of the collective consensus is propelling the fiat-based economy to new heights. Within these heights are the growth rates we are told to see. So for us not to understand and harness the financial economy, it would be an epic fail.

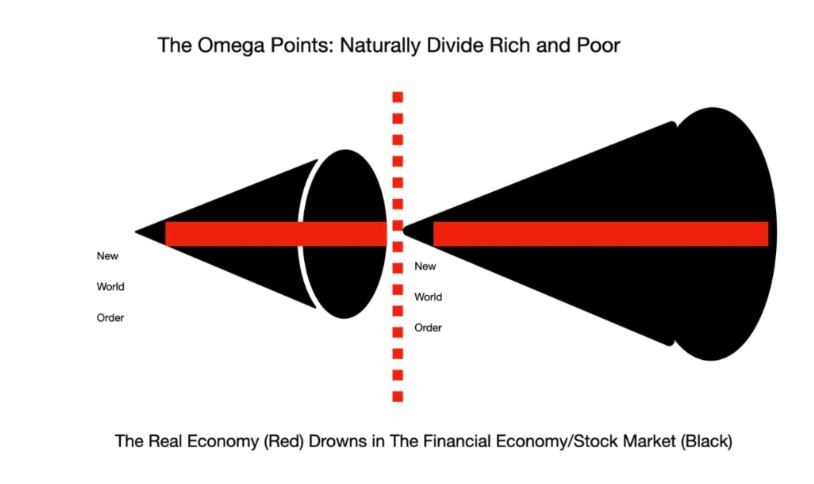

The financial economy makes the world go round, yet oddly it only exists in the mind. How can we decode what we cannot sense? Yet, it is unequivocally real. The Omega Point: Zero - Dark - Infinity

We must focus on the origin of all numbers to truly understand the game of finance. That is, Zero (origin) and it’s opposing, infinity. These two combined form a singular force that slowly by surely leads to the Omega Points. Always.

This point holds true for nations too. All countries are incepted from singularity until they more or less follow the sequence of states:

· New World Order: Constitutional Framework

· Capital Development: Pain and Prosperity

· Capital Development: Debt Bubble

· Capital Development: Wealth Divide

· Capital Development: Credit Crunch

Generally, we are able to find that the divergence of the real economy and the financial economy is greatest just before reaching the Omega point.

The underlying message is: social unrest and class divide only occur due to measurement. Who has more, who has less. Measurement is calculated by expanding numbers of the financial economy relative to the ‘real’ economy. The fuel is fiat money which has been expansive because it can be debt. The greater the trust in the financial economy the higher regard or reserve status that the currency has to be in order to be a source of growth through debt. This accelerates the growth of countries through debt at a faster rate relative to hard money or bartering. This is why the failure of countries which naturally reach the Omega Point is so high at 80%. The lesson is that the more you accept the ontological economy, the more numbers you can accumulate - the higher up you are on the totem pole. This is why technocrats are running the economy. They are masters of math & numbers that makes them immune to the dark justice of the natural wealth divide.Dark Justice: Inequality to Infinity

As we are rearing close to the end of the cycle of states (sequence above), it is important to find clues in history to help us navigate these peculiar times.

Pandemics, war, and social divide in the past have all lead to one thing, that is, revolutions! And government reform. Upon further inspection, these types of events that have occurred in the past, are eerily reoccurring today, in an almost identical manner.

Some stand-out notes:

Case 1: The War and Pandemic There are many pandemics and war factors that have historically impacted the decline in capital and return on capital in this period of time. Re-distribution of resources like the stimulus checks, rising inflation and physical distribution. Knock-on Effects: -Unionization -Welfare State -Social Solidarity ‘we’re in this together-The disruption of a society catalyzed by a pandemic and pursued by civil war are extremely rare occurrences in history.

It’s in 1918. The world is at war and influenza is fast spreading. Its origins are unclear. But a neutral contender to the war and the first country to officially record plague figures (260k deaths) in Spain. Thus, we have the ‘Spanish flu’. Following its pandemic, there is large scale unrest resulting in the all-out civil war. Is COVID really the ‘Chinese flu’?

Case 2: Civil Culture War and Pandemic -Gold and FX reserves had been virtually wiped out,-The devastation of war had reduced the productive capacity of both industry and agriculture.-Trade sanctions due to WWII lead to global shortages of wartime materials and peacetime industrial products.-There was uncontrolled profiteering by the minority who had access to the markets of the poor. This impacted state taxation and its redistribution. -The empire’s longevity, its emperor, and the ruling class’s wealth and power were dependent on its taxpayer base. The bigger and wealthier this was, the bigger and wealthier the empires.-The wealthy elite was and are still the only ones that can afford to spark a revolution.As the civil war ends, there is a class struggle between liberals and conservatives, about whether to reform government or prevent reforms. Spain emerges from the civil war with formidable economic problems.

Following all this chaos does it take us to a better? The answer is no.

Rebels Without A Cause: Wealth Divide in Effect

All new societies start with the tangible real economy. But this can sustain for only so long. Eventually a financial economy in our minds forms. Those that are able to play the game help propel it forward, and in turn, it helps propel those that play it well forward. A feedback loop of sorts.

Studying the socialist societies of the past we find that following revolutions and reform, wealth and class divides are erased. Societies generally do reach states of ‘Utopia’. There are periods of singularity and equality. The only drawback is that these periods are short-lived.

We can see that in the formation of the Soviet Union which achieved exportation, capital, and wage destruction with a Gini coefficient below .03. Ditto for their communist comrades.

Great Leap Forward of China (1958) Reform Agrarian economy into a communist society.

DOI MOI of Vietnam (1986) Reform into "socialist-oriented market economy".

Self Reliance and “Purification” of Cambodia (1975) Reform into collectivization of agriculture.

These societies were all aiming for a Utopian dream-like state, which they claimed to have achieved. But this sense of ‘utopia’ only lasted for a short time. And it came at a detrimental cost. Fear, Unrest, Violence, Destruction, and Death. There is always death. Funny that these are all things we are able to witness today just by turning on the TV or reading the daily news.

Was it worth it? It is clear today that Technocrats are the ruling class and the government is just the new bourgeoisie. The divide between the real economy and the financial economy is greater than ever but even this statement is irrelevant to the technocratic ruling class. They are the masters of math and ontologically control both realms with the all-important certainty of the number. There is only one way to engage and hack the system of numbers.

Podcast Coming Soon!

Some reported altered state of consciousness will describe their experiences in mathematical patterns.